The Australian dollar rallied a bit during the course of the trading session on Thursday to reach towards the 0.74 level. That is an area that had previously been support, so the fact that it offered resistance should not be a huge surprise. As we continue to see a lot of “risk off” in general when it comes to the bond markets, it does make a certain amount of sense that the US dollar strengthens. Furthermore, the Australian dollar is giving up a lot of strength due to the fact that the Australian economy has been shut down by the government.

Furthermore, the Chinese economy has been slowing down and therefore you also have to keep in mind that the Australian dollar is highly correlated to that economy. Australia is a major supplier of raw materials to the Chinese economy, and as a result it is likely that as long as there are problems between Australia and China when it comes to the trade spat, that is also another issue. Ultimately, another thing that we need to pay close attention to is the fact that the 50 day EMA is reaching towards the 200 day EMA in order to form a “death cross.”

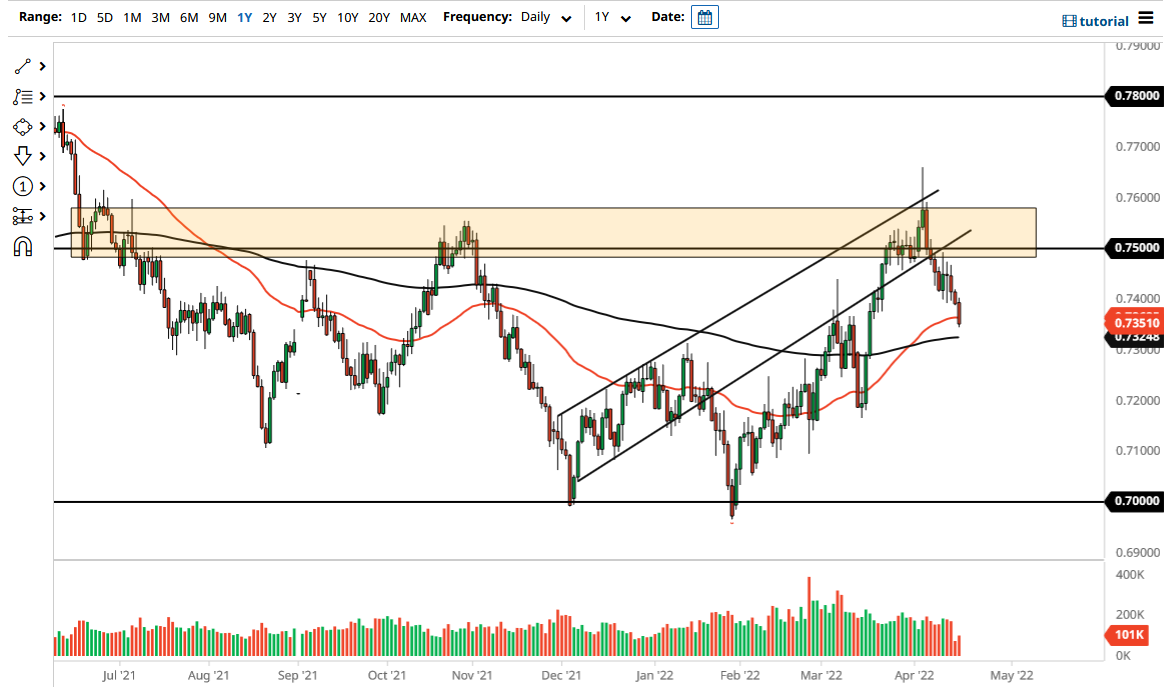

Looking at this chart, I believe that the 0.75 level above would be a major resistance barrier, and I do not think that we are going to break above there anytime soon. In fact, the fact that we gave up so much of the early gains during the trading session suggests to me that we are going to continue to see a lot of noisy behavior, and it is likely that we will continue to see a bit of hesitation. At the longer-term, the market is likely to go looking towards the 0.70 level underneath which is a large, round, psychologically significant figure that had previously been important.

Furthermore, there was a previous head and shoulders pattern that measures for a move down towards that general vicinity, so I think that given enough time we will fulfill that move. It is not until we break above the 0.76 level that I would become bullish, as it certainly looks a bit sluggish at this point and of course bond yields in America continue to drop, showing that people are putting money into the bond market itself.