The Aussie dollar has broken down again during the trading session on Thursday as we continue to grind lower. This makes quite a bit of sense considering that Australia is in the midst of killing its own economy via lockdowns again. That certainly will do no good for the value of the Aussie dollar, and it is more likely than not we continue to go much lower. With that in mind, I like the idea of fading short-term rallies as it should be plenty of opportunities to short this market.

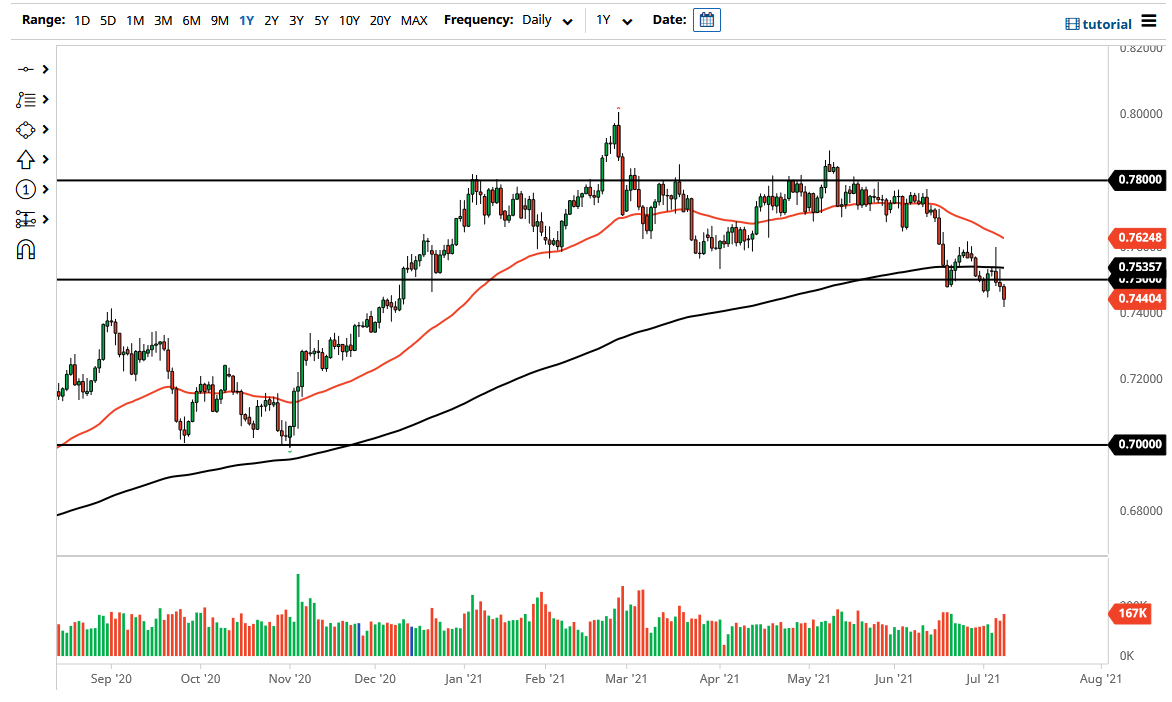

The 0.75 level above is an area that will attract a lot of attention due to the psychology of that big figure, but also the fact that it had previously been supportive. When you look at the massive candlestick on Tuesday, that was really the biggest “heads up” that we are getting ready to make another move. After all, the market had initially rallied due to the statement by the RBA, and then gave back all of those gains within roughly 12 hours. By the end of the day, we have close that candle at roughly the bottom of the range, which of course suggests that there will be little bit of follow-through. On Wednesday, we try to recover again but then were stop dead and the 200 day EMA, so that was yet another signal that this could happen.

Now that we have pierced this support, I think we are starting to change the overall trend. Longer-term, I would not be surprised at all to see this market go looking towards the 0.71 level, which is the “measured move” of the head and shoulders pattern that has just gotten broken through. With that in mind, I think the US dollar has further to go, and even though it may be a bit of a bumpy ride lower, that is how I am looking at things until we break above the top of the candlestick from the Tuesday session at the very least, if not the highs of the week before because quite frankly this is a horrible look and we have confirmed the “H pattern” by breaking down below it as well. Markets are starting to take on a decidedly “risk off tone”, and the Australian dollar will more than likely be one of the casualties of it.