The Australian dollar fell again during the trading session on Tuesday but did see a little bit of buying underneath to form a hammer again. I am starting to see the pattern across several currency pairs right now that the US dollar is slowing down its gains that it has been enjoying as of late. That is not a huge surprise, as the Federal Reserve is meeting late during the day on Wednesday and we will see a reaction in the US dollar in general.

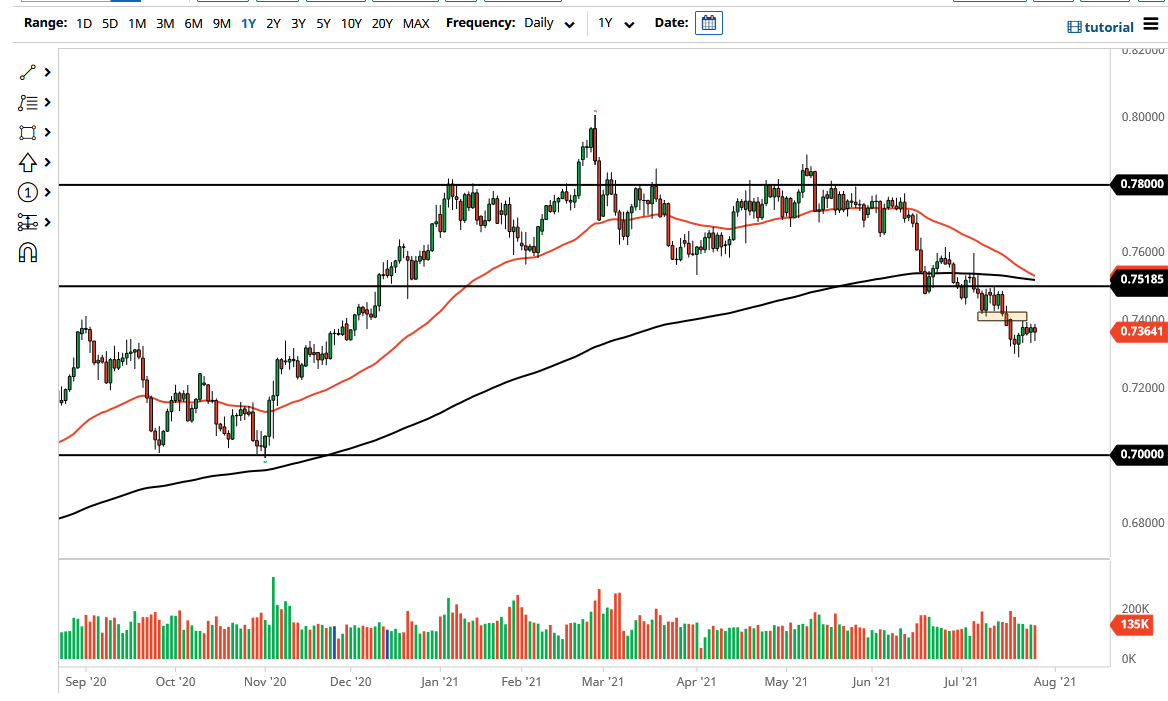

You can see that we have clearly broken down through multiple support levels, and it now looks to me like the 0.75 level is the “ceiling in the market” that we need to pay close attention to. The 50-day EMA rolling over and reaching towards the 200-day EMA is forming a “death cross” that is a longer-term signal that a lot of people will look towards. With that being the case, it is very likely that we will see some type of volatility coming out. Furthermore, the Australian dollar also has the misfortune of being attached to the Australian government, which will not stop locking its economy down.

When I look at the formation on the chart, I suspect that we could get a little bit of a bounce, but I believe that looking for signs of exhaustion to sell will probably be the way I trade this market, because the Australian dollar has further to go to the downside. On the other hand, if the market was to break above the 0.76 level, then it is likely that the Aussie will continue the longer-term uptrend. Nonetheless, this is a market that I think continues to see a lot of volatility and, given enough time, I think we have got a scenario in which we could get a bigger move down to the 0.70 level, but obviously we have gotten a little oversold in the short term. Ultimately, I think that one thing you can probably count on is a lot of noisy behavior as the markets simply have no idea where they want to go next, as there are also concerns when it comes to China in general.