Bullish View

Set a buy-stop at 0.7380 and a take-profit at 0.7450.

Add a stop-loss at 0.7250.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 0.7350 and a take-profit at 0.7250.

Add a stop-loss at 0.7450.

The AUD/USD remained in a consolidation mode as traders focused on the latest Australian inflation, lockdown news, and the upcoming FOMC decision. The pair is trading at 0.7365, where it has been in the past few days.

Australia Inflation

Australia’s consumer prices rose by 3.8% in the second quarter as the rising crude oil prices pushed petrol prices significantly higher. The overall CPI rose to 0.8% from the first quarter while the trimmed mean came in at 0.5% and 1.6% on a year-on-year basis. The trimmed mean is the Reserve Bank of Australia’s favorite inflation measure.

The main contributors of higher inflation in Australia were the unwinding of the government’s childcare package, higher prices and higher electricity prices. The cost of electricity rose by 3.3% after the government removed the $600 electricity credit.

The AUD/USD is also wavering after the government extended the Sydney lockdown by additional four weeks as it battles the new outbreak. New South Wales also continued seeing more cases. Still, there is hope that the government’s business support will be helpful to businesses.

The government will offer $156 million in business continuity. The fund will provide up to $5,000 grants to more than 30,000 businesses like cafes and restaurants. There will also be a $70 million licensed hospitality fund and $80 million relief for landlords.

Looking ahead, the AUD/USD pair will react to the latest Fed interest rate decision. The bank is expected to conclude its meeting during the American session. Analysts, going by the bank’s guidance, expect that it will leave interest rates unchanged. It will also signal that the first rate hike will come in 2023. Further, the bank will maintain its quantitative easing policy in a bid to provide more support to the economy.

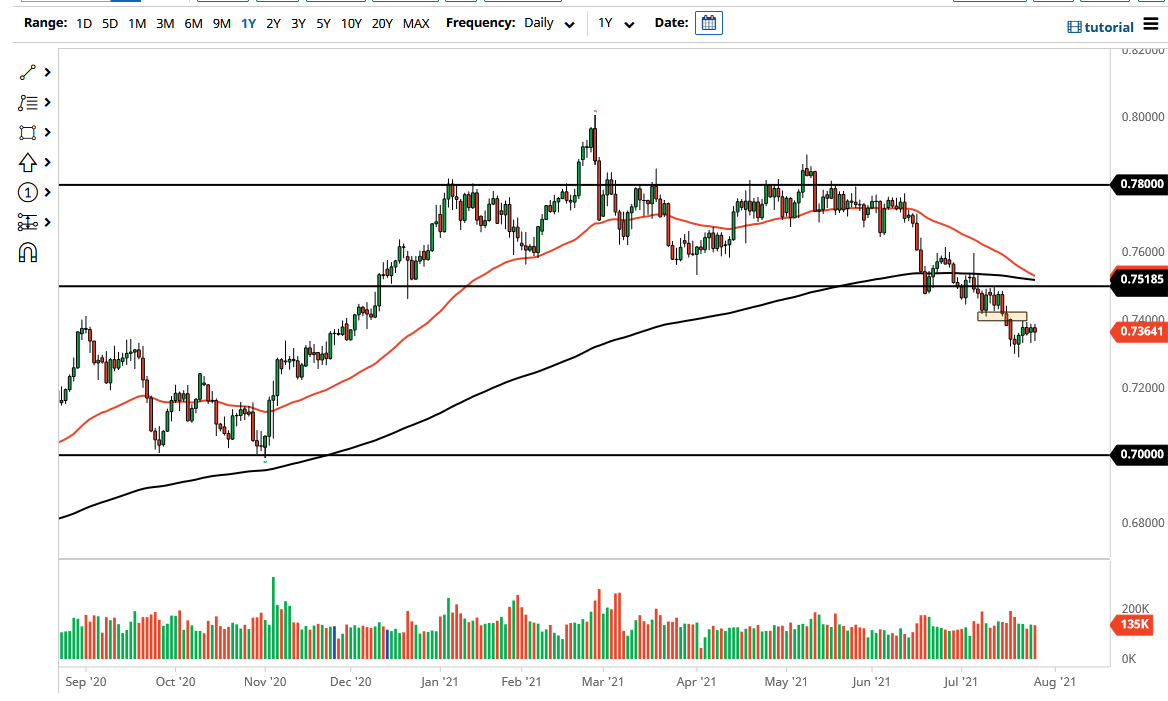

AUD/USD Technical Outlook

The AUD/USD has been moving sideways in the past few days. It is trading at 0.7365, which is between the important support and resistance level of 0.7330 and 0.7400. As a result, the pair is trading at the same level as the 25-day and 50-day moving averages. It is also slightly below the 38.2% Fibonacci retracement level while the MACD is slightly below the neutral level. Therefore, the pair will likely see a bullish or bearish breakout ahead or after the Fed decision. The key levels to watch will be 0.7330 and 0.7400.