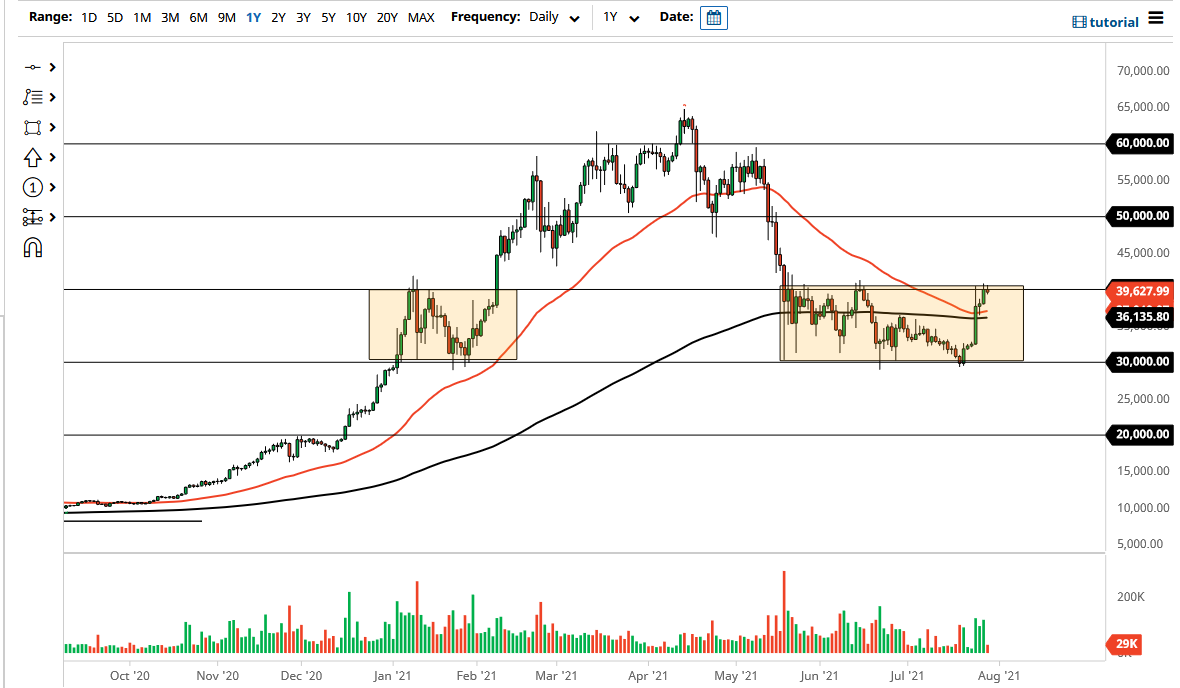

The market is currently sitting at the $40,000 level, which is of course an area that I have spoken about more than once. The $40,000 level is the top of a larger consolidation area, which means that the market will continue to find a little bit of exhaustion here. At this point, it is a bit questionable as to whether or not we have the momentum to continue to go higher but judging by the way the market closed out I think we may have a bit of a fight on our hands. We got here off liquid, so quite often that means that we may struggle to keep up the necessary momentum to go higher.

Looking at the charts, you can see that the $30,000 level underneath was significant support, and as a result we are still technically in the consolidation, so at this point in time not much has changed with the exception of the short-term momentum. Given enough time, I think that if we break above the 41,000 level, the market is going to go looking towards the $50,000 level above, which of course is the previous support level before the breakdown. It is also a large, round, psychologically significant figure that a lot of people will pay attention to, so I think it makes a nice target.

If we do pull back from the $40,000 level, we might break down below the lows of Wednesday, which could open up further selling. Keep in mind that the 50 day EMA and the 200 day EMA indicators are both sitting just above the $36,000 level, so we may have to pay close attention to that level if we do break down. Keep in mind that the overall consolidation range that the market is trying to escape from is worth $10,000, so it all ties in quite neatly to the $50,000 theory.

It will be interesting to see how this plays out over the next couple of days, due to the fact that the main thing that sent the market running higher was short covering that came about due to the fact that there were rumors that Amazon was going to start accepting Bitcoin. Having said that, they have refuted that rumor.