The bitcoin market has fallen during the course of the trading session on Thursday, as we continue to see a lot of negativity around the world. The bitcoin market has been no different, especially as the US dollar has spiked again during trading on Thursday as the 10 year yields dropped below the 1.3% level. (Yes, I know that bitcoin faithful do not think that other markets have anything to do with it, but the reality is that as soon bitcoin was starting to be adopted by institutions, it became yet just another commodity.)

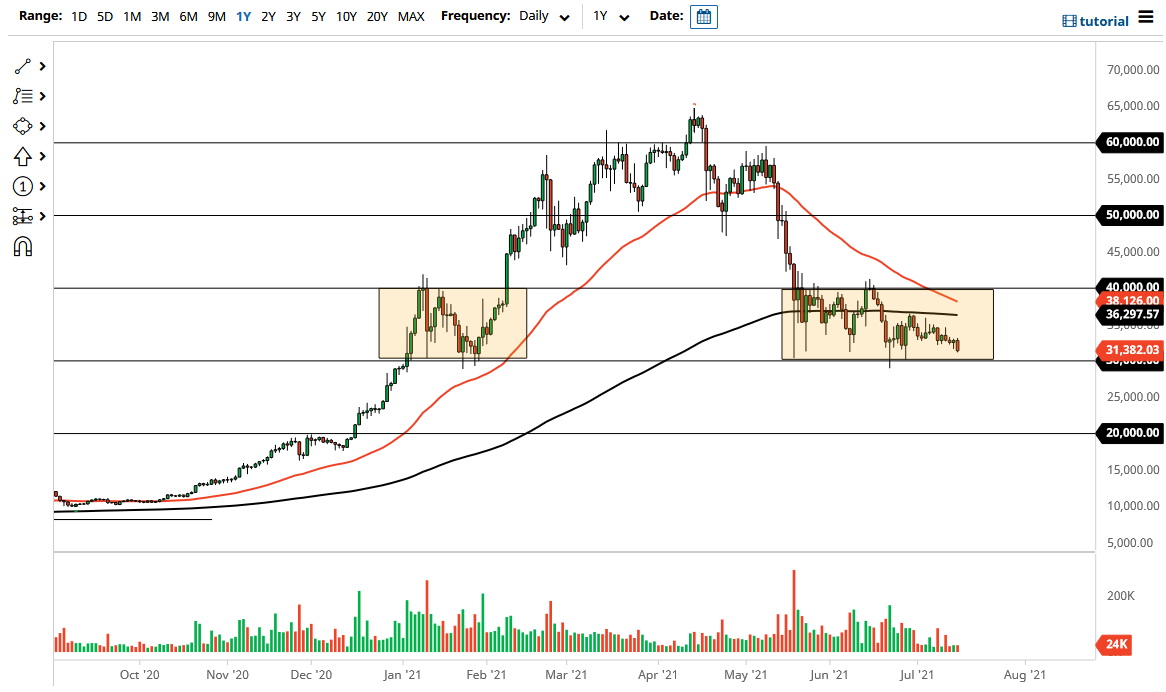

As the 10 year yields dropped below the 1.3% level, this cause the US dollar to strengthen, and by extension caused bitcoin to drop as you see on the chart. Furthermore, bitcoin has been falling against the dollar every time it has tried to rally over the last couple of weeks anyways. It looks as if the 200 day EMA continues to be a major resistance barrier, and the fact that we could not break above it over the last couple of weeks tells me that we are more likely than not to see this market finally break through the $30,000 level rather quickly. What will be the cause? At the end of the day, it really does not matter.

I anticipate that what we will see is some type of correlation between the strengthening US dollar in the falling bitcoin market. You may also see a lot of trouble in other markets as well, with perhaps the exception of bonds. (Again, I know this is a bit of a stretch for some, but bonds are the TRUE store of wealth for large funds.) With that being said, as more bonds are needed by traders around the world, they will forget about things like bitcoin and start collecting greenbacks to buy those “risk free assets.”

If we break down below the $30,000 level, it is very likely that the market goes looking towards the $20,000 level underneath. In fact, I expect that mood to be quite rapid. The question then becomes whether or not $20,000 can even hold the market, which at this point in time I do not even know if I would bet on that. A move below that level opens up the official “crypto winter”, which is going to be a great buying opportunity down the road. As far as buying is concerned, there is nothing on this chart that even remotely suggests you should be thinking about it.