The Bitcoin market rallied significantly during the trading session on Wednesday, bouncing from the crucial $30,000 level. At this point, it is obvious that the $30,000 level is being heavily defended, but we should also point out that there is a significant amount of downward slope to what we have seen as of late. Unless we are suddenly going to see a massive surge in interest, I suspect that the rally will probably continue to attract sellers at the first signs of exhaustion. That being said, it is worth noting that the market closed at the very top of the range for the session.

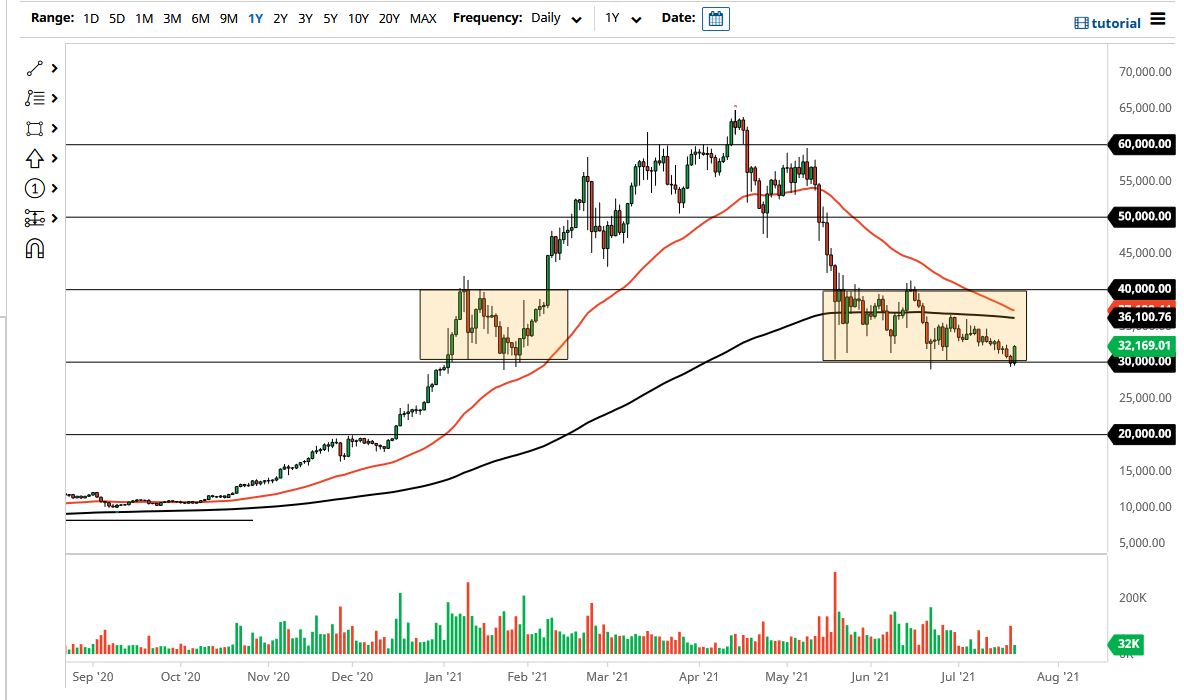

When I look at this chart, it most decidedly is slumping to the downside. A break above the top of this candlestick could lead to a bit of a continued recovery, but I do believe that somewhere around the $35,000 level we are going to see a significant amount of resistance again. Quite frankly, nothing has changed in the market to think that there is going to be a sudden turnaround. Furthermore, the 200-day EMA currently sits at the $36,100 level, and the 50-day EMA of course is starting to turn into that indicator, suggesting that we may end up forming a bit of a” death cross” before it is all said and done.

Bitcoin has taken a series of body blows during the last several months as China put pressure on regulators to stop facilitating crypto transactions, and then went after the mining operations as well. In fact, things had gotten so out of whack that the algorithm's main difficulty of solving a block had fallen four times in a row recently. In other words, the usage on the block chain just was not enough to perpetuate things.

The biggest problem with Bitcoin at the moment is that people are still trying to figure out what it is. So far, it has only served as a speculative asset, which is perfectly fine as long as you are aware of that. Whether or not it has any real value of the longer-term is a completely different question, and not one that I care to know the answer to. At the end of the day, we are trading it in trying to make a profit. In that light, I believe that if we break down below the lows of the last couple of sessions, we will finally drop $10,000 to reach down towards the $20,000 level. Otherwise, I will be looking for signs of exhaustion to fade for short-term selling opportunities.