The Bitcoin market fluctuated during the trading session on Tuesday after a wild ride on Monday due to manipulation from the UK involving Amazon. What I mean by this is that it was released in a London newspaper that Amazon was going to start possibly accepting Bitcoin as payment soon, based upon a job posting. It took all of about half the day for Amazon to come out and suggest that this is categorically untrue.

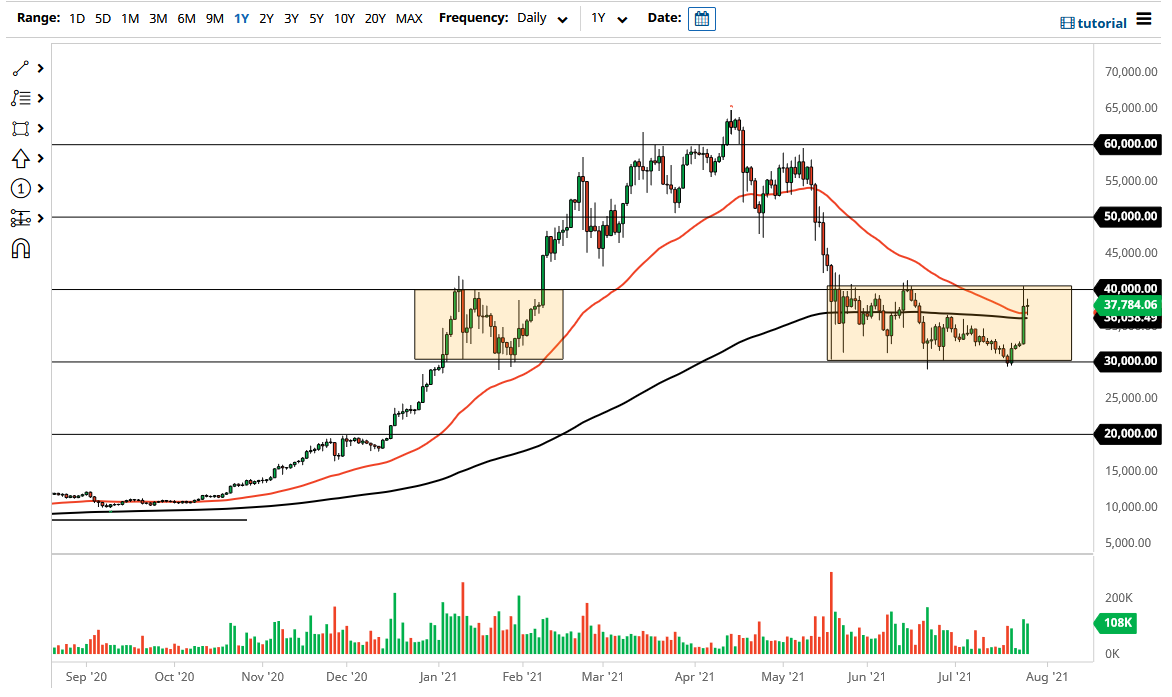

Furthermore, there is also the issue of Tether. The company behind the stable coin is now facing a criminal investigation from the Department of Justice in the United States, which is not a good look. There is a huge amount of Bitcoin transacted using Tether, so the actual fallout from that situation could be impactful. At this point in time, the market is likely to hear a lot of questions asked about where we are going next, because even though we have seen this market take off based upon manipulation and short squeezing, the reality is that we did not break out. The next couple of days will be crucial for the Bitcoin market, as we are still stuck between the $30,000 level on the bottom and the $40,000 level on the top.

The 50-day EMA is reaching towards the 200-day EMA, and if it were not for the shenanigans pulled during the trading session on Monday, it is very possible that we may have already had the so-called “death cross” form. That does not necessarily mean that it is the end of the market, just that a lot of longer-term traders might be a bit concerned about this. We need to close above the $40,000 level on a daily close in order to get aggressively long, and even at this point it is possible that we could go looking towards the $50,000 level. That is an area that previously had been support, so it will probably be resistance going forward. Nonetheless, I think the action on Tuesday suggests that the market is in a “wait and see” type of scenario. All eyes are on the Federal Reserve on Wednesday as well, so it will be interesting to see what they do when it comes to monetary policy and the effect on the US dollar, which will be felt over here as well.