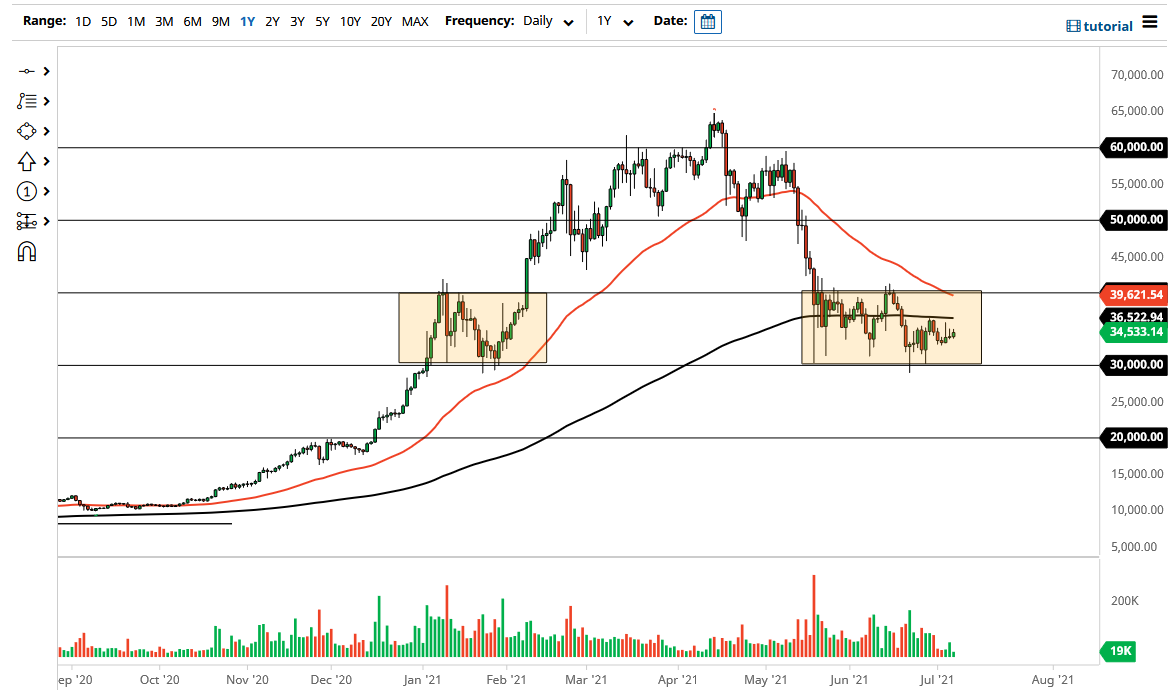

The Bitcoin market rallied ever so slightly during the trading session on Wednesday as we continue to grind back and forth just below the $35,000 level. The market also has the 200-day EMA sitting just above it at the $36,525 level, so I think there are some certain technical issues just above that could cause a bit of resistance. At this point, the market continues to respect that resistance, so that is most certainly something worth paying attention to.

Adding more ammo to the bullish case is that the 50-day EMA has now reached below the $40,000 level, an area that was the top of the recent consolidation area, and we could see a little bit more bearish pressure due to the technical indicator. Furthermore, it is worth noting that the most recent test of $30,000 did not send the market racing to the upside and back towards the top of the consolidation, which typically means that we are about to see more negativity given enough time. If we do break down below the $30,000 level again, I think we will start to break down and go on to look towards the $20,000 level, which makes sense considering that it is a $10,000 “tall” rectangle that we are bouncing around in, so that would be your measured move.

There is also the possibility that Btcoin will rally, but it is not until we break above the $40,000 level that I would be thinking about going long. If we can break above there, then the market is likely to go looking towards the $50,000 level above, based upon that same measured move mentioned previously. The $50,000 level will attract a lot of attention and cause a lot of headlines. It was previous support, so that should in exigent make this significant resistance.

Nonetheless, this is a market that I think will continue to see a lot of choppy trading in the short term, but we have got a couple of major areas to pay close attention to, because it will give us an idea as to where the next $10,000 comes from and which direction it is found. If we break down below the $20,000 level then we will enter a “crypto winter.”