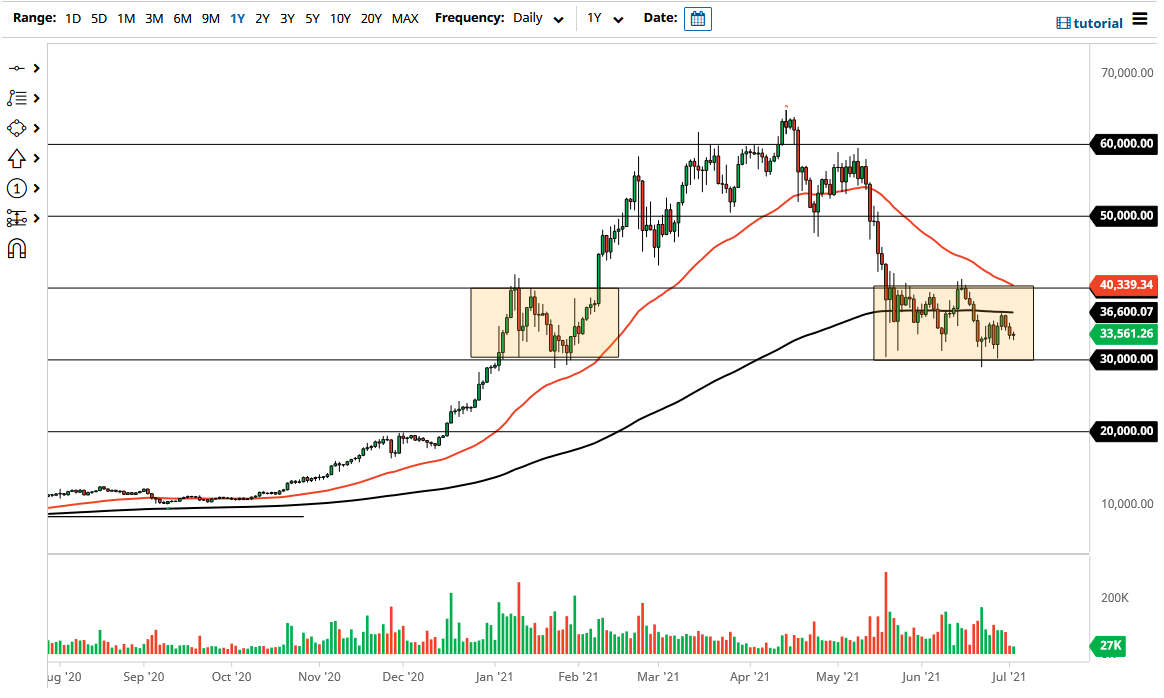

Bitcoin fluctuated during the rather quiet trading on Friday, as most traders were paying close attention to the jobs number more than anything else. That being said, the market is likely to continue to hear a lot of questions as to where we go next. After all, Bitcoin has recently bounced from the $30,000 level couple of times, but simply cannot pick up much in the way of momentum.

The 200-day EMA sits above and is going sideways near the $36,600 level. With that being the case, the market is likely to continue to keep that 200-day EMA in mind, offering an opportunity to use it as a measuring stick of strength. To the downside, the $30,000 level continues to be a bit of a target for sellers, as it has clearly been a major support level. At this point, if we break down below the $30,000 level, then it is likely that we could break down rather significantly. It certainly looks as if the market is trying to break down through there, as we are chipping away at that region.

If we were to break down below the $30,000 level, it is likely that the market would go looking towards the $20,000 level, as the rectangle is roughly $10,000 in height. With that being the case, the market is likely to see a lot of interest in that area, as the $20,000 level is not only the measured move, but it is also where we had peaked during the previous bubble, so I think there is a certain amount of “market memory” that we need to pay close attention to in that area. In other words, if we were to break down below the $20,000 level, it is likely that this market would fall apart.

On the other hand, if we were to break above the $40,000 level, then it is likely that we would go looking towards the $50,000 level above, as that is the measured move of the rectangle. Furthermore, the $50,000 level was previous support, so it should now offer resistance anyway. That being said, the market is likely to continue seeing a lot of noisy behavior, but at this juncture we need to see a breakout to start trading with any size whatsoever.