Bitcoin gained over 20% in one shot during the trading session on Monday as there had been reports of Amazon posting a job opening for someone to take care of cryptocurrency transactions. Ultimately, this has people speculating that Bitcoin is going to be accepted by Amazon, and as a result traders went wild with the assumption that adoption will drive prices higher. Furthermore, there is an argument to be made that the short covering during the session had a huge part of play with the overall move.

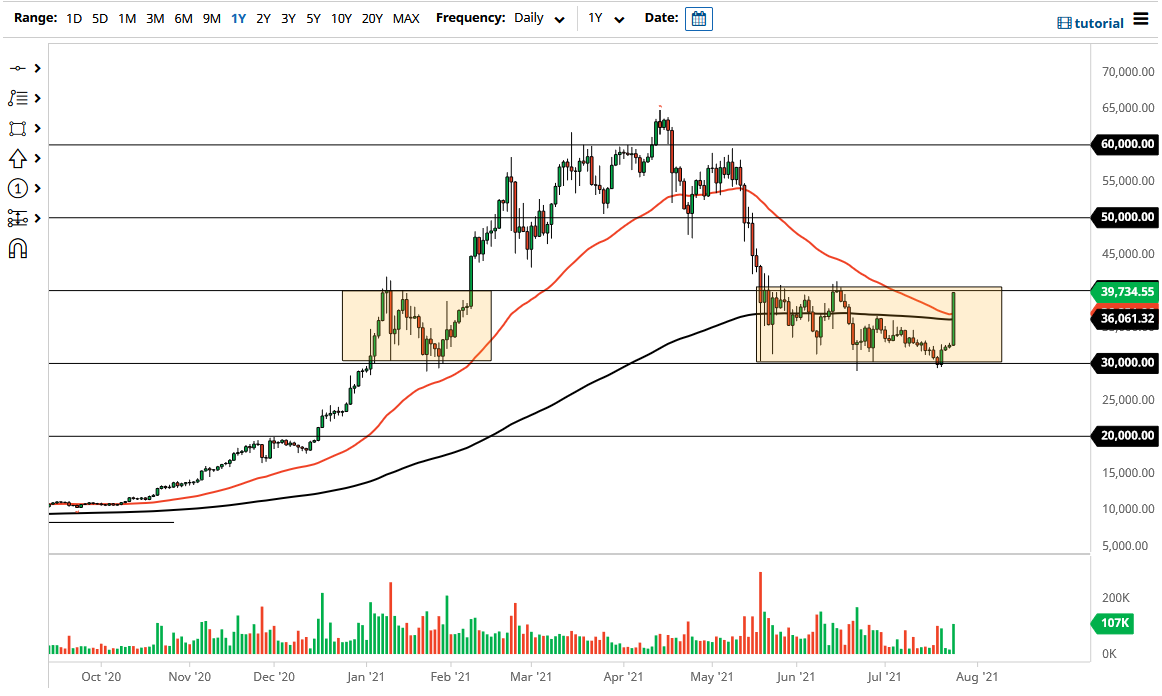

It is worth noting that the market has stopped right at the $40,000 level, which is an area where we had seen massive resistance previously, so it will be interesting to see whether or not we can continue to go higher. It certainly looks as if we could, but what also has me worried about this is that if there is any type of denial by Amazon that they are going to accept Bitcoin, that will send this thing into a tailspin so quickly that it will be almost impossible to get out of the way of the falling knife.

One thing is for sure: the question now becomes whether or not there will be any follow-through. If you are not already long of this market, it is going to be very difficult to start buying here. After all, chasing a 20% move in one day is a great way to “chase the trade.” If we can get a daily close above the $40,000 level, that could open up the possibility of a move towards the $50,000 level. However, if we do get Amazon denying adoption of Bitcoin, I think that we could very easily crash back towards the $30,000 level. Unfortunately, when you get the sudden shift in attitude like this based upon a rumor, things can get very dangerous. That being said, I think that the markets are more than likely going to continue to be very difficult, but this could be the beginning of something rather large if we can take off. Otherwise, I suspect that we will turn around and fall right back to where we were and continue the same behavior we had seen before. If we break down below that $30,000 level, then it is possible that we could go to the $20,000 level.