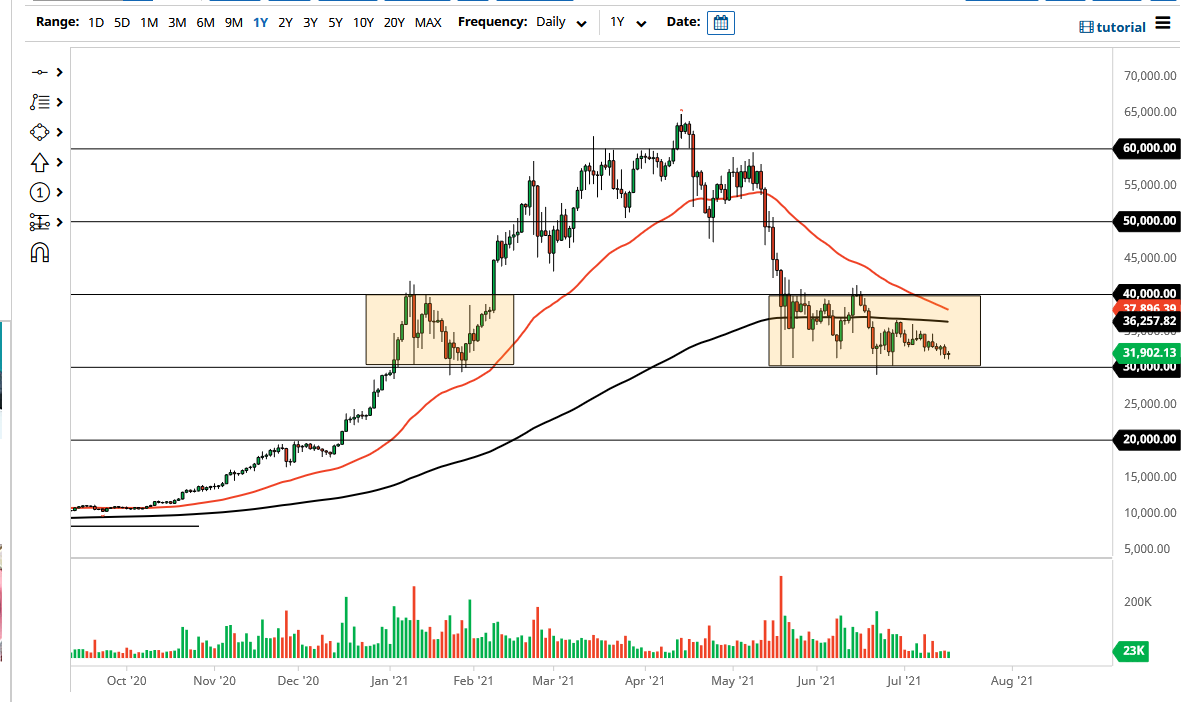

The Bitcoin market fluctuated during the trading session on Friday as we continue to hover just above the $30,000 level. At this point, I think it is only a matter of time before the market breaks down below the $30,000 level, opening up a much bigger move to the downside. The consolidation area is roughly $10,000 tall, so if we break down below the $30,000 level, it is likely that we will go looking towards the $20,000 level.

On the other hand, if we were to somehow magically break above this consolidation area, clearing the $40,000 level opens up the possibility of going towards the $50,000 level. The $50,000 level will attract a certain amount attention due to the fact that it was previous support and I think it would be resistance if we were to reach that area.

Looking at the 200-day EMA, it is obvious resistance at the $36,250 level, and it is also worth noting that the 50-day EMA is starting to reach towards that level as well, setting up a potential “death cross.” The US dollar has been on a tear lately, and it looks as if it is going to continue to strengthen. That being said, the market is denominated in US dollars, so if the greenback does continue to strengthen, that should put pressure on this market as well.

Bitcoin started selling off quite rapidly before the Chinese announced the ban on mining, but only just before. This is a trick that the Chinese Communist Party has done more than once, where they allow certain high-ranking members to get their money out of the market or even the country before crashing a market. The question now is whether or not miners picked back up to previous levels? Nonetheless, I think there are far too many things working against Bitcoin to make it go much higher in the short term. This is a very sickly-looking chart and I do not see any realistic scenario in which we have the buyers come back into the market and push this market much higher. I believe that we are more likely than not to see the $20,000 before we see $40,000. If we break down below the $20,000 level, is very likely that we enter a “crypto winter.”