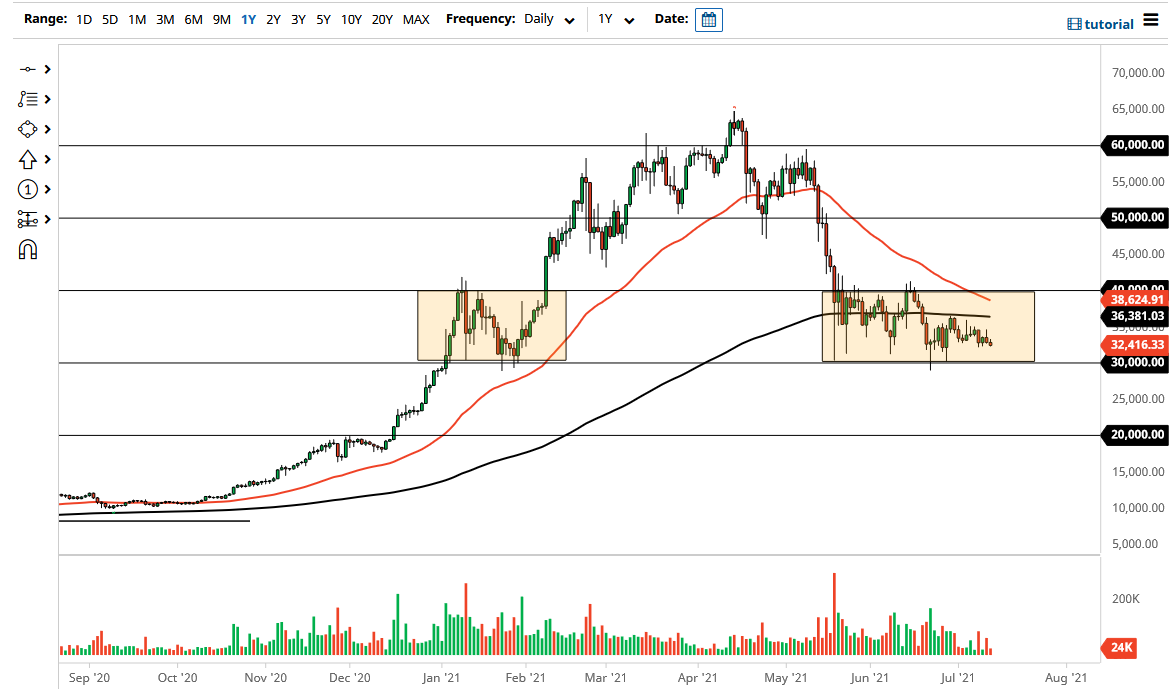

The Bitcoin market initially tried to rally during the trading session on Tuesday, but then broke down again as we continue to see bearish pressure in this market. The Bitcoin market is one that continues to see a real lack of momentum to the upside, especially as we have seen a lot of volume disappear from the marketplace. The $30,000 level underneath should continue to be important, but if we were to break down below that level it would obviously show a complete breakdown of support, and if that is going to be the case, it should open up fresh selling.

Breaking down below the $30,000 level should open up a move down to the $20,000 level, and there is nothing on this chart that suggests we cannot get down there. Rallies at this point continue to see sellers jump into this market, especially as the 200-day EMA has offered a bit of a lid in the marketplace. That is currently at the $36,380 level, and that looks as if it is a resistance barrier. If we can break above there, then the 50-day EMA is starting to drift lower as well, getting ready to form the so-called “death cross.” That is a technically bearish signal and could send this market lower.

In fact, I believe that Bitcoin needs to break above the $40,000 level before it can be bought, unless you are a longer-term holder of Bitcoin, and in that scenario, it is more about investing than anything else. That is fine, as there is a longer-term story when it comes to Bitcoin as well, but you will more than likely have to deal with a significant pullback in this market in the near term. Unless we have some type of catalyst, I do not see how this would lift significantly. The Chinese have banned Bitcoin mining, and the market has not recovered since then. I believe that Bitcoin is on the verge of breaking down, and it is likely that we could see a nice buying opportunity at much lower levels. This is a market that should continue to hear noise to begin with, which typically means lower pricing.