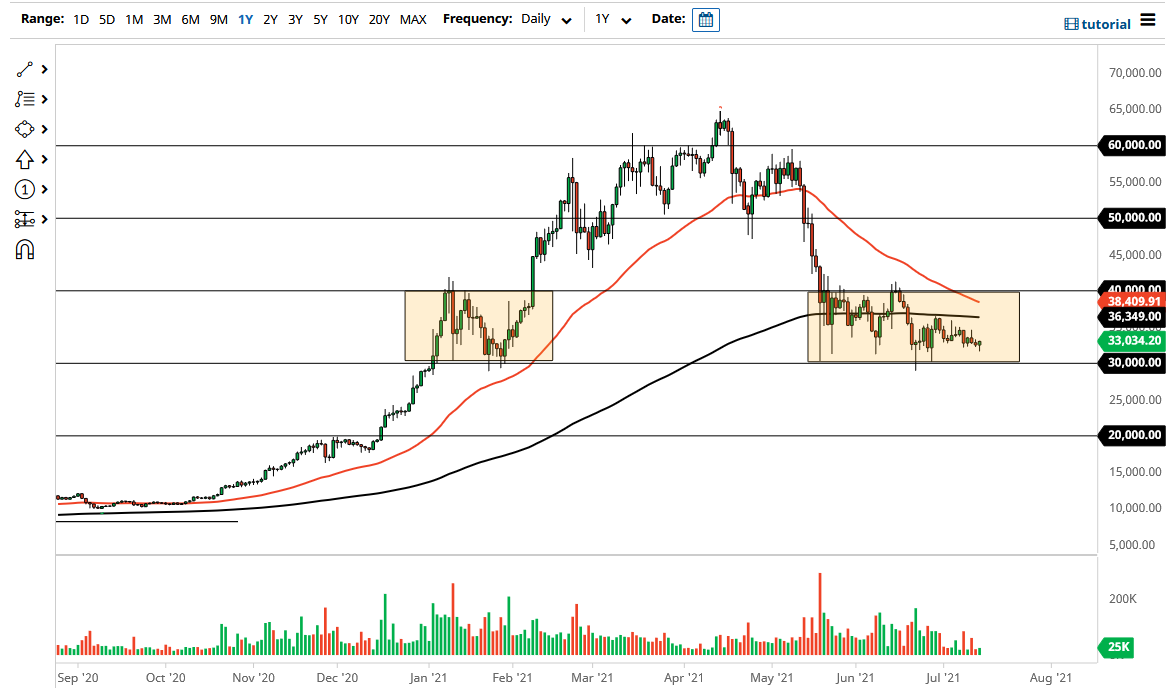

The Bitcoin market initially fell during the trading session on Thursday to reach down towards the 31,500 level before bouncing and forming a hammer. That being said, we still look very sluggish and I am not necessarily looking to get long of this market right now. After all, the market has failed to get above the 200-day EMA for a while now, and the most recent bounce was lackluster to say the least. With this being the case, I think we will continue to see sellers jumping into the market to push the market lower.

If we were to break above the 200-day EMA, it would be a bit of a surprise considering just how low the volume has been. Furthermore, the 50-day EMA is starting to reach towards the 200-day EMA, forming the “death cross” that a lot of traders will pay close attention to. With this, it is going to take a lot of work to save Bitcoin from falling, but that is going to be good news for longer-term investors, because if we do break down below the $30,000 level underneath, that could lead to a decent value proposition.

If we were to break down below the $30,000 level, then it is likely that we could go looking towards the $20,000 level, which was the top of the previous bubble in the Bitcoin market that caused so much selling off. The $20,000 level will almost certainly see a lot of support, and it is the “measured move” of the overall rectangle that we are currently in. The $20,000 level being broken to the downside will unwind Bitcoin quite drastically, and then at that point, it really is anybody’s guess as to where we could go.

To the upside, if we were to break above the $40,000 level, that then would put the $10,000 move into play to the upside, opening up the possibility of a move towards the $50,000 level. At that point, there was significant previous support, so it should be resistance. Beyond that, you also have to keep in mind that the $50,000 level will create a lot of headlines, which tend to move Bitcoin quite a bit, due to the fact that there is such a heavy retail presence in this market.