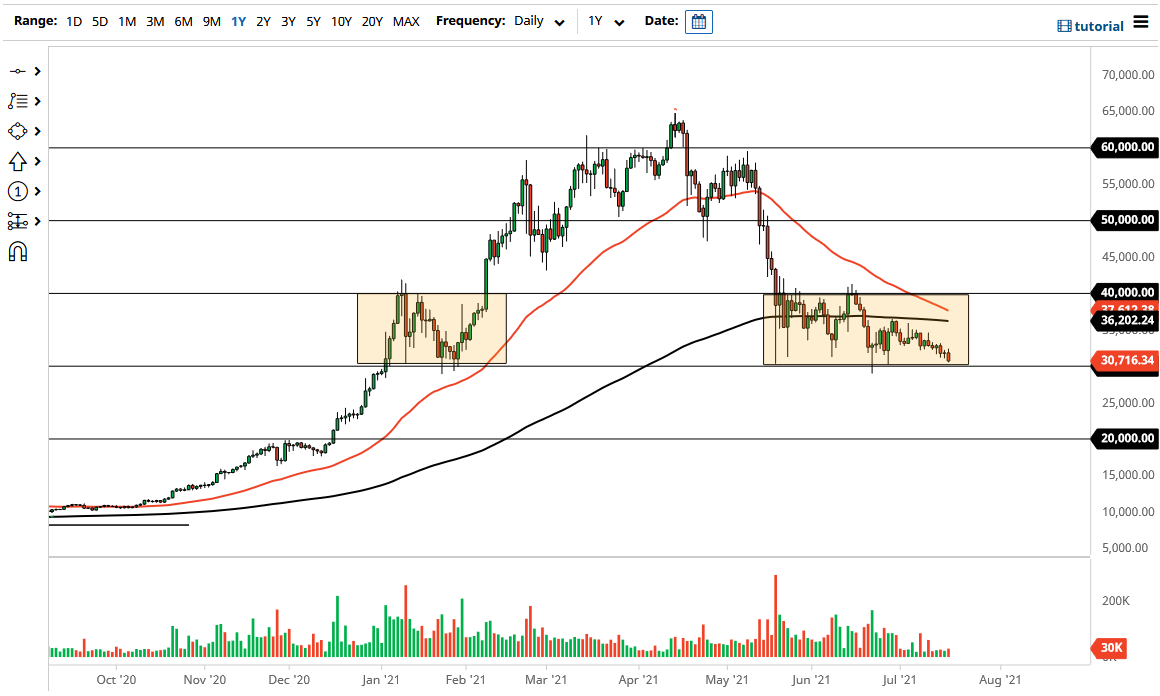

The Bitcoin market initially tried to rally during the trading session on Monday but fell yet again. At this point, we are approaching the $30,000 level, and it looks like it is only a matter of time before we break down below it. If and when we do, this could open up significant selling pressure in this market, which cannot seem to pick up any type of positive momentum. At this juncture, I would fully anticipate that the market would take out the “measured move” of the consolidation that we currently seeing.

Breaking down below the $30,000 level on a daily close opens up the possibility of the $10,000 “measured move” that suggests that we are going to go looking towards the $20,000 level. The $20,000 level is particularly interesting, not just due to the fact that the number is a large, round, psychologically important figure, but it is also where the market had top-down during the last major bubble, so I think there is a certain amount of interest in that level as well due to that reason alone.

If we were to break down below the $20,000 level, that opens up a huge move lower, perhaps setting up what is known as a “crypto winter”, when there is really nothing going on to make the market profitable, and there is just a simple accumulation phase. We had last seen that a couple of years ago, when the market was simply hanging around the $4000 level. That is the rub when it comes to trading crypto: it tends to be very driven by emotion more than anything else, so retail traders are probably driving this lower in and of itself. The question at this point in time is: what will you do if Bitcoin does fall apart? For myself, I hope we get well below $10,000, so that I can start to accumulate again.

There is the possibility that we will turn around and recover, but right now I just do not see that happening. We have the “death cross” above, and it is not until we get above the $40,000 level that I would be convinced that the buyers have taken over again. When you look at this chart, there really is not much to cause confidence.