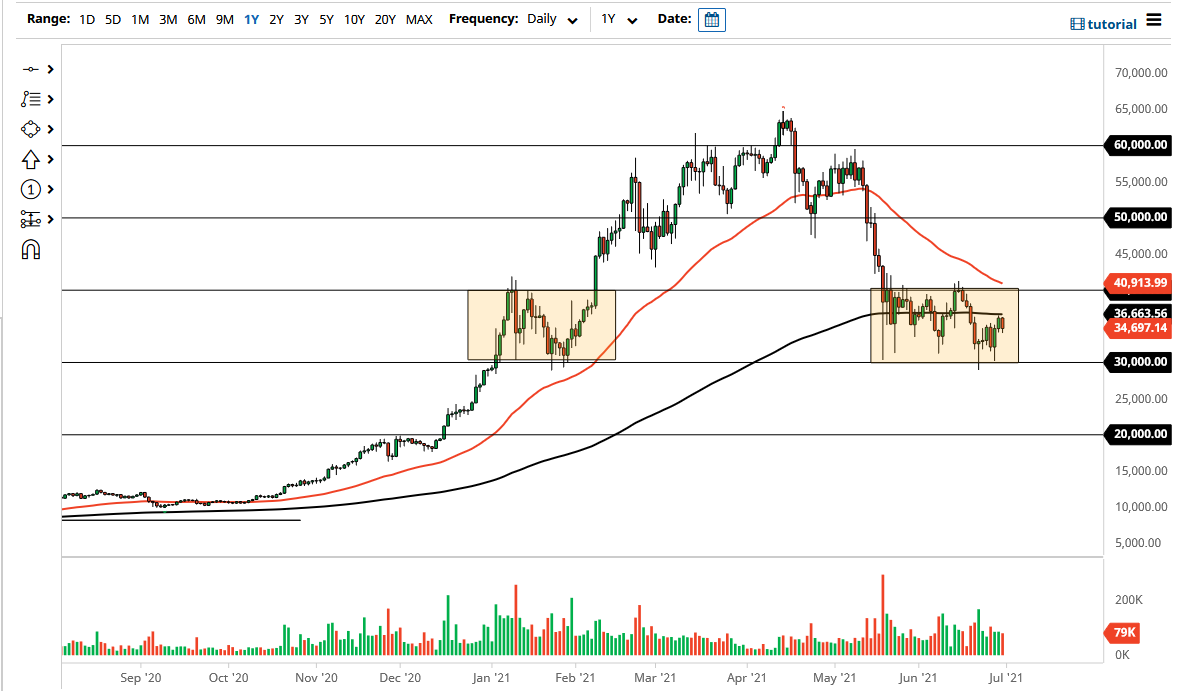

The Bitcoin market pulled back just a bit during the trading session on Wednesday, as the 200-day EMA has offered significant resistance. The market is still very much stuck in a relatively well-defined consolidation region between the $30,000 level on the bottom and the $40,000 level on the top. At this juncture, I think it is only a matter of time before we have to make a bigger decision based upon a breakout, but in the short term it looks like we are simply going back and forth.

The 200-day EMA is flat, and that suggests that perhaps the market is not ready to go anywhere. This is a market that I think needs to make some type of longer-term decision, but at this point we still have no real confidence in either direction. Eventually, though, we will break out of this $10,000 area on a daily close, and then go looking to move $10,000 higher or lower, depending onin which direction we break out.

The US dollar has a certain amount of influence as well, as the Bitcoin markets are priced in US dollars most of the time. The market continues to be very noisy in general, and I think that will be what you can count on through the rest of the summer. After all, there are a lot of questions when it comes to the inflationary situation, and whether or not there is some type of significant regulatory crackdown on cryptocurrency in general. We have seen the Biden administration make a few moves towards the sector, but at the end of the day the market has dropped over 50% recently, and that suggests that we still have plenty of trouble ahead.

The $20,000 level underneath is the next support level after the $30,000 level, and it should be noted that that is the area where we had pulled back from after the last time Bitcoin ended up forming a bit of a bubble. If we break out to the upside and clear the $40,000 level, then we will more than likely go looking towards the $50,000 level. Whether or not we can break above there is a completely different question, and most certainly will see a lot of resistance in that general vicinity.