Bearish View

Short the BTC/USD and add a take-profit at 33,383 (pivot point).

Add a stop-loss at 39,372 (R1).

Timeline: 2 days.

Bullish View

Set a buy-stop trade at 38,500 and a take-profit at 40,000.

Add a stop-loss at 37,000.

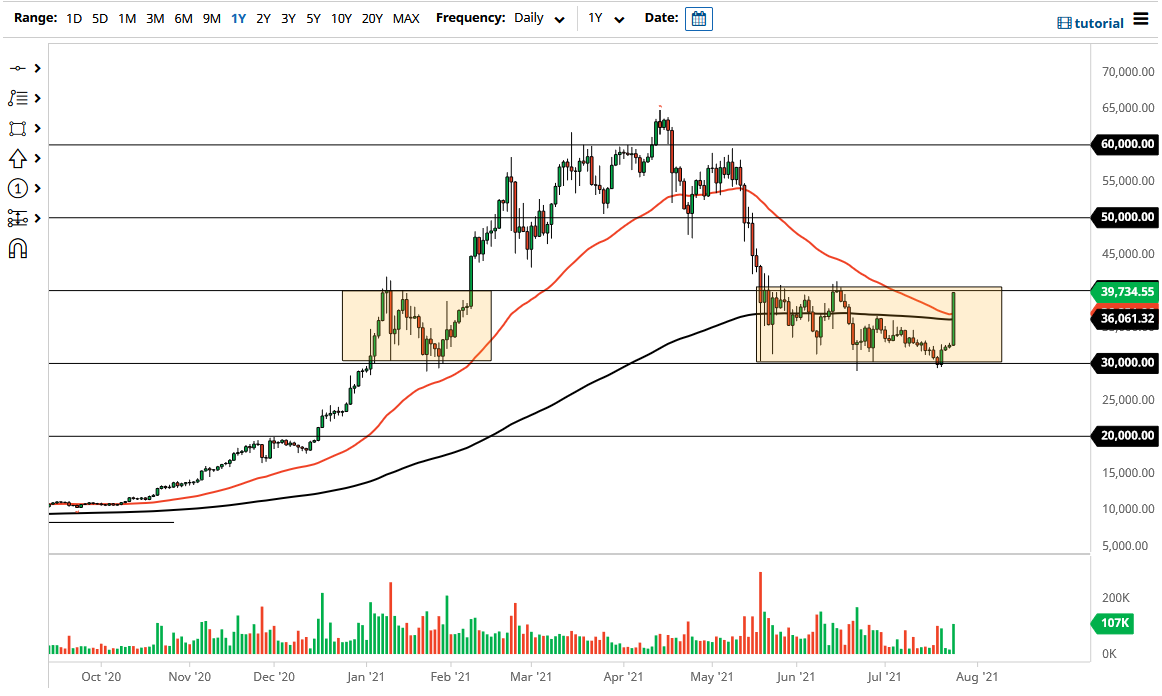

The BTC/USD retreated in the evening session after it rose to a six-week high on Monday. The Bitcoin price is currently at $37,116, which is about 8% below its highest point this week.

Bitcoin Price Retreats

The BTC/USD staged an impressive week in the past seven days after it dropped below the important support at $30,000. The coin rose to more than $40,000 after a series of positive catalysts.

First, US bond yields have declined significantly in the past few weeks. The 10-year yield has dropped to 1.286%, which is substantially lower than the year-to-date high of 1.77%. This decline is a sign that investors expect that the resurgent American inflation is easing.

As such, it is sending a signal that the Federal Reserve will maintain its dovish stance in the next few meetings. The most immediate meeting will start on Tuesday with the decision coming on Wednesday. A dovish Fed is usually positive for risky assets like Bitcoin and growth stocks.

Second, the BTC/USD rallied after last week’s B Word Conference. In it, Elon Musk made news when he talked in-depth about his interest in digital currencies. He also confirmed for the first time that SpaceX had invested in Bitcoin. On Monday, Tesla said that it still held its Bitcoins and that it suffered a loss of about $23 million in the second quarter.

Third, Amazon confirmed that it was exploring the cryptocurrencies space. This is after the company made a job listing of a blockchain developer. Some media sources said that the firm was considering building its token and offering Bitcoin as a payment option later this year. It is still early to tell since exploring can mean different things for a firm like Amazon. Still, if these rumours are correct, it would be a big thing for Bitcoin and blockchain technology. Bitcoin price also rose as more than $740 million of short positions were liquidated on Monday.

BTC/USD Technical Analysis

The BTC/USD retreated after it crossed the important resistance level at 40,000. On the 4H chart, the pair also declined after hitting the second resistance of the standard pivot points. The current level is at important support since this was the highest point on June 29. The upward trend is also being supported by the 25-day and 50-day moving averages. Still, in the near term, the bearish trend will likely continue as bears target the pivot point at 33,383. The price will then rise above this week’s high of 40,500 later this week.