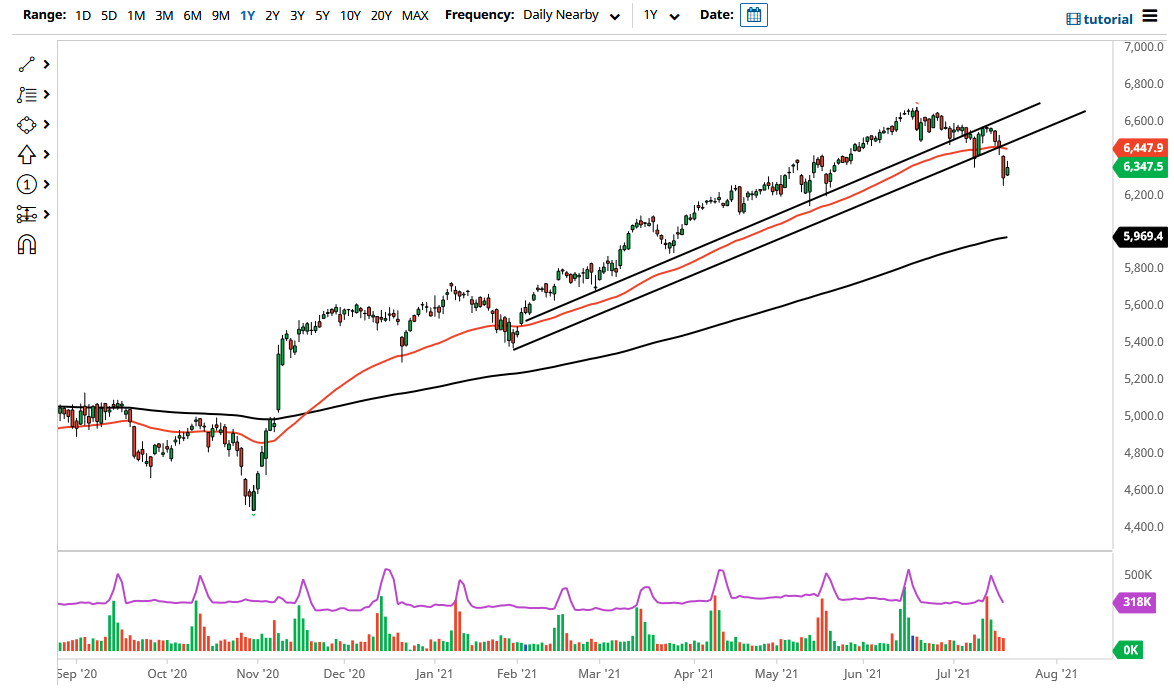

The CAC Index gapped a little bit higher to kick off the trading session on Tuesday to show signs of positive momentum. After that, we then rallied towards the 6375 handle, to form a positive-looking candlestick, and it is interesting to see that the market has formed a bit of a “harami”, which is considered to be a bullish signal. If we can break above the top of the candlestick for the trading session on Tuesday, it is very likely that we will go looking towards the gap above to fill it. The 50-day EMA currently sits at the 6450 handle, so that is yet another reason to think that the market may hesitate in that area. The market also has to deal with the previous uptrend line, so it should end up being resistance given enough time.

If we do get close to that area, I would be looking to short that market based upon exhaustion. After all, the Parisian index has been a bit of a laggard against other major indices in the European Union, so I think it would not be a huge surprise to see this market pull back. Furthermore, we could just simply fall to break down below the nasty candlestick from the Monday session, which would show extreme weakness. At that point, I would anticipate that the market would go looking towards the 200-day EMA to go towards the 6000 handle.

To the upside, if we were to see a break above the gap, that could open up the buying to much higher levels, but right now it does not look very likely to happen. Nonetheless, if that move does occur, I anticipate that we will go looking towards the 6600 level, followed by the recent highs of the market which were basically 6700. Obviously, that would be a large “risk on” type of move, possibly opening up stock markets around the world to even higher moves. That being said, pay close attention to the DAX as well, because it is considered to be the “bellwether” for the European Union, so if it starts to rally, it will drag the CAC right along with it. However, if that market starts falling, I would be much more apt to get short of this market, as it just simply does not have the same blue-chip aspects as Germany has.