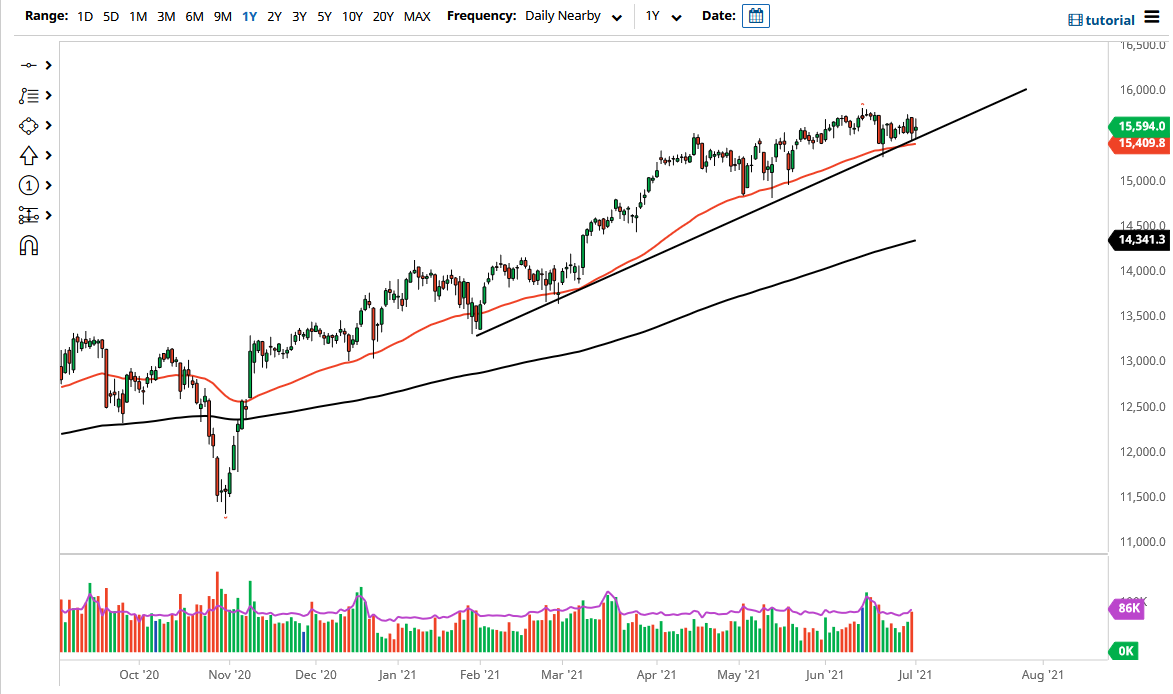

The DAX has gone back and forth during the trading session on Thursday as it looks like we are bit hesitant to continue going higher. That being said, we do have a nice uptrend line just below and of course the 50 day EMA is walking right along that trendline. When you look at the most recent action, you can make a bit of an argument for an ascending triangle, so I think we are trying to build a little bit of an ascending triangle, as we compress volatility.

It should be noted that we have recaptured the 15,500 level, so I think it is only a matter of time before we go looking towards the 16,000 level, but I also think it takes a bit of time to get there. We are simply grinding slowly, but we are stable more than anything else, and that in and of itself is a rather bullish sign. The uptrend line has held so far, as you can see based upon the daily candlestick for the Thursday session itself.

If we break down below the 50 day EMA, then it is possible that we could go looking towards the 15,000 level, which is an area that I think will attract a lot of attention from both a psychological and structural standpoint of view. Ultimately, I think that if we give ourselves enough time, there should be plenty of buyers in that area to jump on board in push this market to the upside. As things stand right now, I do think that there is plenty of support underneath to keep this market going forward, but obviously if we were to break down below the 15,000 level, then it is likely that we could fall even further, but I think this would coincide with several other indices around the world falling at the same time as it would be a major “risk off move.”

On the other hand, if we see other major indices such as the S&P 500, FTSE 100, and Nikkei 225 all rally, that could provide enough bullish bias in the DAX to continue reaching towards higher levels. While things have been a little bit choppy over the last couple of weeks, there is nothing on this chart that has me worried about the overall trend or the move higher.