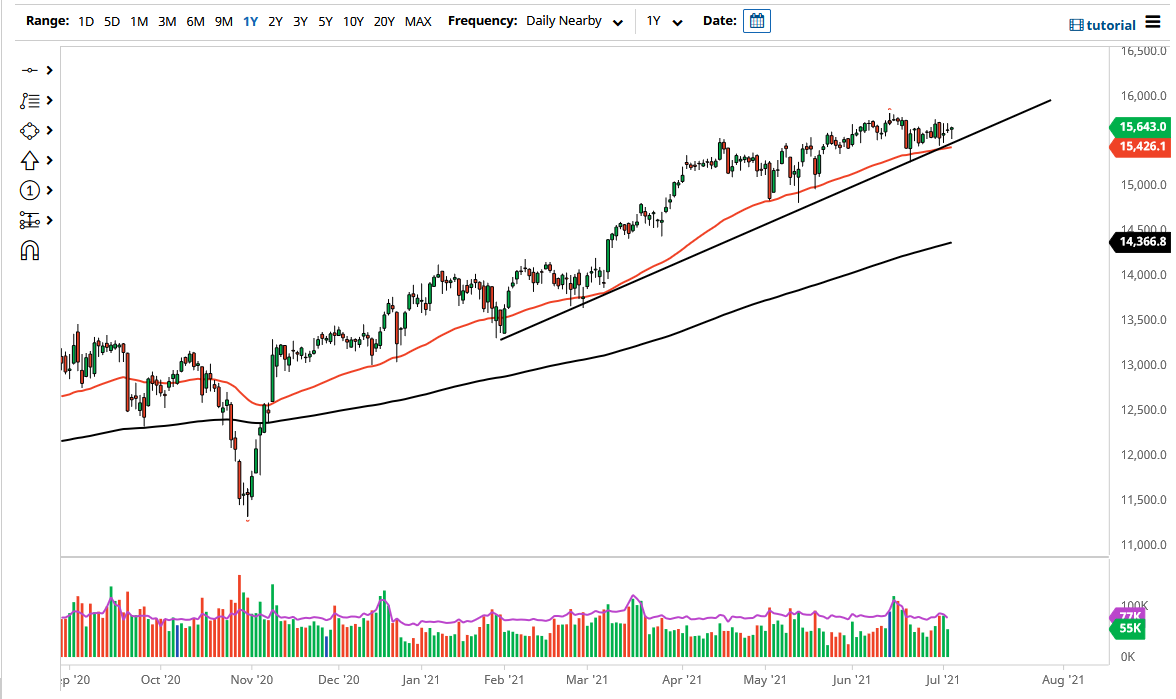

The DAX Index fell initially during the trading session on Monday but recovered nicely from the trendline that has been so important for so long. Because of this, it looks like we are going to see a lot of the upward pressure continue that has been so crucial for markets over the longer term. With this being the case, think that it is only a matter of time before the DAX goes looking towards the highs, which is sitting right around the 15,800 level.

Looking at the DAX Index, you can also see that the 50-dday EMA is in the picture, so I think it is more than likely going to continue to be a scenario where the buyers are coming in every time it dips, as the DAX is one of the first places that the general public will go to invest if they want to get involved in the European Union. Furthermore, the German economy is one of the major drivers of the EU in general, so it makes sense that we would see the DAX pick up in reaction to value hunting. The 50-day EMA underneath has been followed quite extensively, so if we break down below that level then I think it is possible that the DAX goes looking towards the 15,000 handle.

If we were to break down below the 15,000 level, then it is likely that the market could go much lower, as it would be a significant breach of not only structural support, but also psychological support. To the upside, I think that the 16,000 level is probably the target, and the fact that we did up forming a bit of a hammer does suggest that we are going to continue to see buyers. Ultimately, this is a market that is also trying to form a bit of an ascending triangle, so that comes into play as well. The “measured move” of the ascending triangle suggests some were around 16,250 as the target. In general, this is a market that remains bullish regardless, so unless we get some type of major “risk off event”, the DAX should continue to show quite a bit of support. One thing I think you can count on is noisy trading, so I would be cautious about how big your position is.