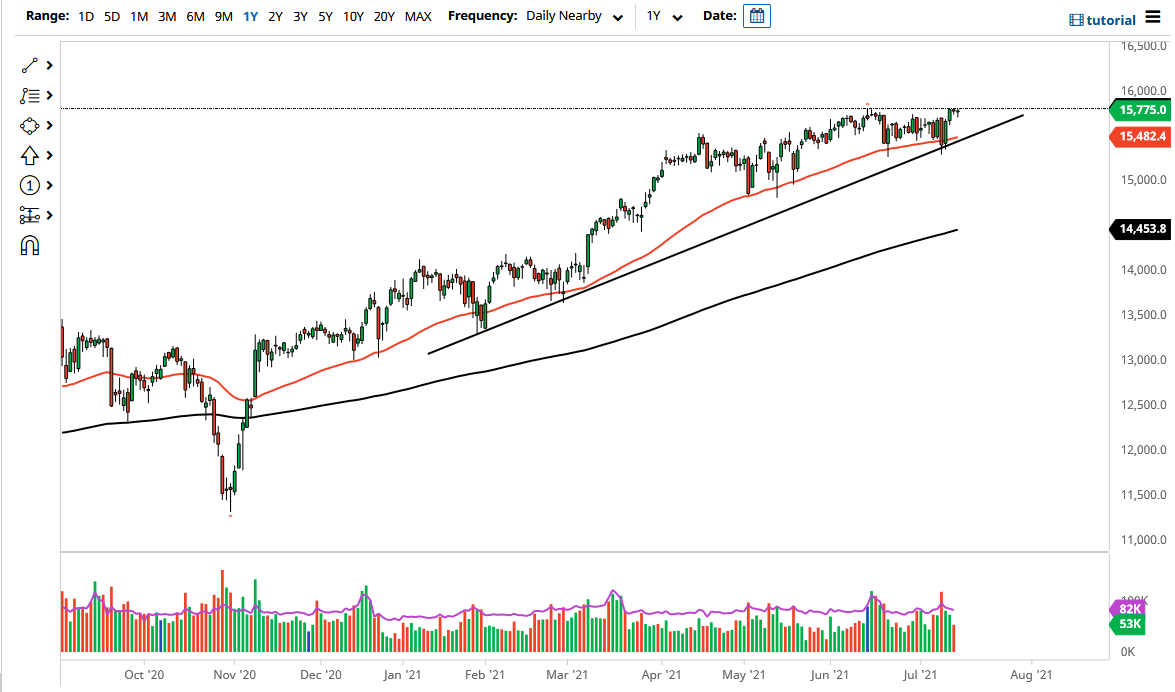

The DAX initially pulled back a bit during the trading session on Wednesday but then turned around to rally towards the highs yet again. At this point, the 15,800 level is continuing to show itself as significant resistance, and if we can break above there then I think it opens up the possibility of a move towards the 16,000 level. When you look at the market, we have obviously been in an uptrend for a while but may perhaps be running out of steam in the short term.

Nonetheless, the DAX is the bellwether when it comes to the European Union, so pay close attention to this market as it can give you an idea as to what will happen with the rest of Europe. That being said, if it starts to selloff, we will probably see more traction and other indices such as the MIB, CAC, AMX, and so on. Alternately, if it starts to rally, it typically will drag other European indices up with it. Because of this, we need to be cautious about trying to trade against the DAX, as it is considered to be so important. Beyond that, it does look as if it is ready to break out; but even if we do get a pullback, there are plenty of support levels underneath that come into place.

There is a big uptrend line that remains important, and we have the 50-day EMA that sits on top of that uptrend line. That is an area that people will be paying close attention to, but even if we were to break down below there, I would anticipate that there should be significant support at the 15,000 level as the 200-day EMA is reaching towards it. That being said, I find it very unlikely that it will happen, but that is a scenario that you have to pay attention to. Breaking below the 200-day EMA in the DAX would almost certainly have other European indices collapsing, as the DAX is considered to be the safest place to put money and is so influential as Germany is something like 80% of the EU economy. The 16,000 level above is the initial target, but I do believe that we will break through given enough time. This is especially true as the European Central Bank continues to keep loose monetary policy.