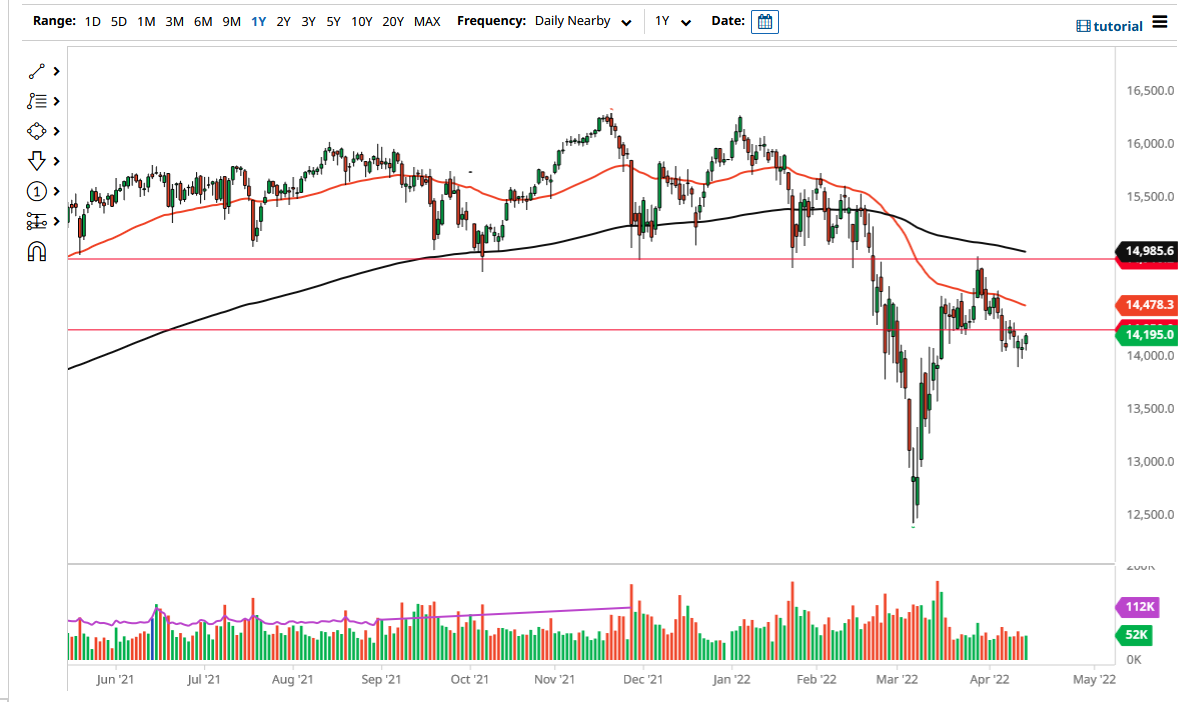

The DAX rallied significantly during the course of the trading session on Thursday but also seems to be struggling right around the previous uptrend line that had been so widely followed. We are just above the 50 day EMA, so that in and of itself is positive, and at this point in time I need to question whether or not we are going to roll over, or if we are simply going to go sideways in this larger consolidation area that we seem to be trying to form.

Looking at this chart, I believe that we'll continue to see a lot of choppy volatility, because we have seen markets sell off drastically earlier in the week, only to recover all of those losses. But “What now?” I think we probably have a lot of questions to ask about markets in general that typically leads to a lot of back and forth. This has been a very messy week, although it is worth noting that it was somewhat resilient in the sense that we did not melt down after that significant move.

If we were to break above the previous uptrend line, then it is possible we could go looking towards the 15,800 level which is a major resistance. That being said, if we can break above that level that is likely that the market could go much higher, with the initial area being 16,000. If we break above that, then it is likely that the market continues to go much higher, as it would continue the overall bullish attitude. Keep in mind that the DAX is considered to be the “blue-chip index” for the European Union, as Germany is the largest part of the economy. Furthermore, Germany is a major export of industrials to the rest of the world, so it is also a play on the overall reopening trade.

It is worth noting that the European Union continues to struggle overall though, so probably this is going to be more or less a “push and pull” type of market in the short term, until we finally make some type of longer-term decision. I would not be surprised at all to see a slightly negative trading session on Friday, but I would not look for any type of massive meltdown.