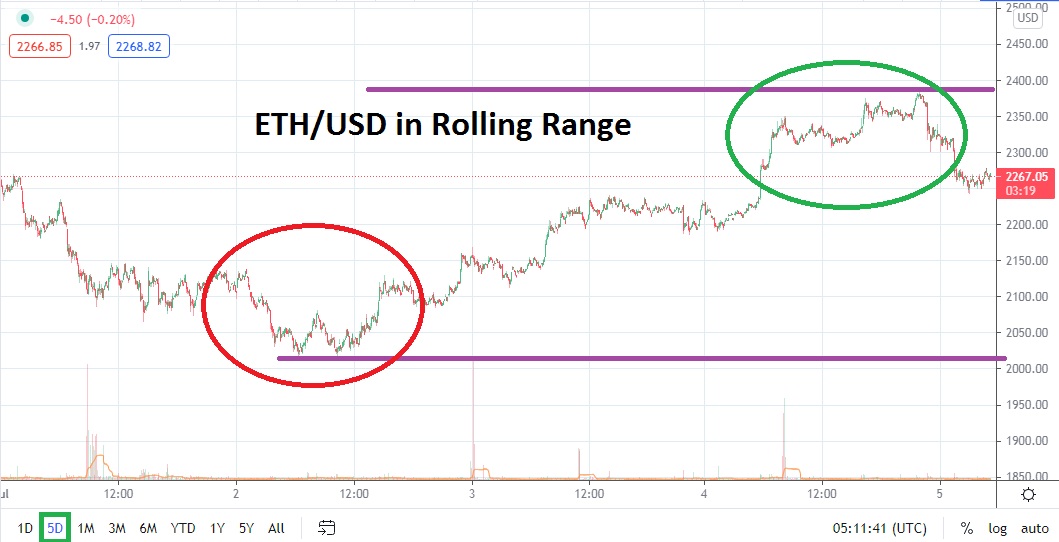

ETH/USD traded near 2390.00 late yesterday, but the cryptocurrency has fallen from highs and is now near 2250.00 as of this writing. The current price vicinity of ETH/USD leaves it within what has become a rather steady precarious range. Ethereum continues to exhibit an ability to create rolling values which test a rather wide price band. On the 2nd of July, ETH/USD tested lows within sight of the 2000.00 level without penetrating beneath.

The past month or so of weekends has produced intriguing price movement; what stands out from the results of this Saturday and Sunday were the gains made in the broad cryptocurrency market, including ETH/USD. The past month or so has seen selling pressure over the weekends, so the result the past couple of days goes against this grain. However, the selling that has developed the past few hours should be monitored because ETH/USD has certainly not left the lower territory of its mid-term price range.

Technical traders who continue to foster bearish sentiment will keep their eyes on the 2200.00 price tag. If ETH/USD stumbles through this level and shows fast trading it could be an indication that another test of lower depths is about to ensue. Traders may want to also keep within their mindset that today is a market holiday in the U.S because of Independence Day falling on a Sunday. Therefore, speculators should pay attention to trading volumes which may be a bit skewed and lacking. Certainly ETH/USD will be traded in the States via platforms, but institutional trading companies are on holiday.

If ETH/USD were to receive a slight push higher and show an ability to trade within the 2275.00 to 2300.00 junctures which are relatively nearby, this may be a sign that another attempt at stronger values may be demonstrated. Speculative bulls may want to see sustained trading within these heights, since they have been burned quite a bit in the past couple of months with rather weak false breakouts.

The sell-off within ETH/USD this morning is another reminder that the cryptocurrency has not had an easy time creating powerful moves higher and maintaining them. Until ETH/USD proves it can break through resistance levels on a steady basis, traders may find that the best opportunities lurk within opportunities to sell Ethereum near resistance marks and place a conservative take-profit order below to take advantage of the lack of confidence which seemingly lingers.

Ethereum Short-Term Outlook:

Current Resistance: 2302.00

Current Support: 2207.00

High Target: 2368.00

Low Target: 2142.00