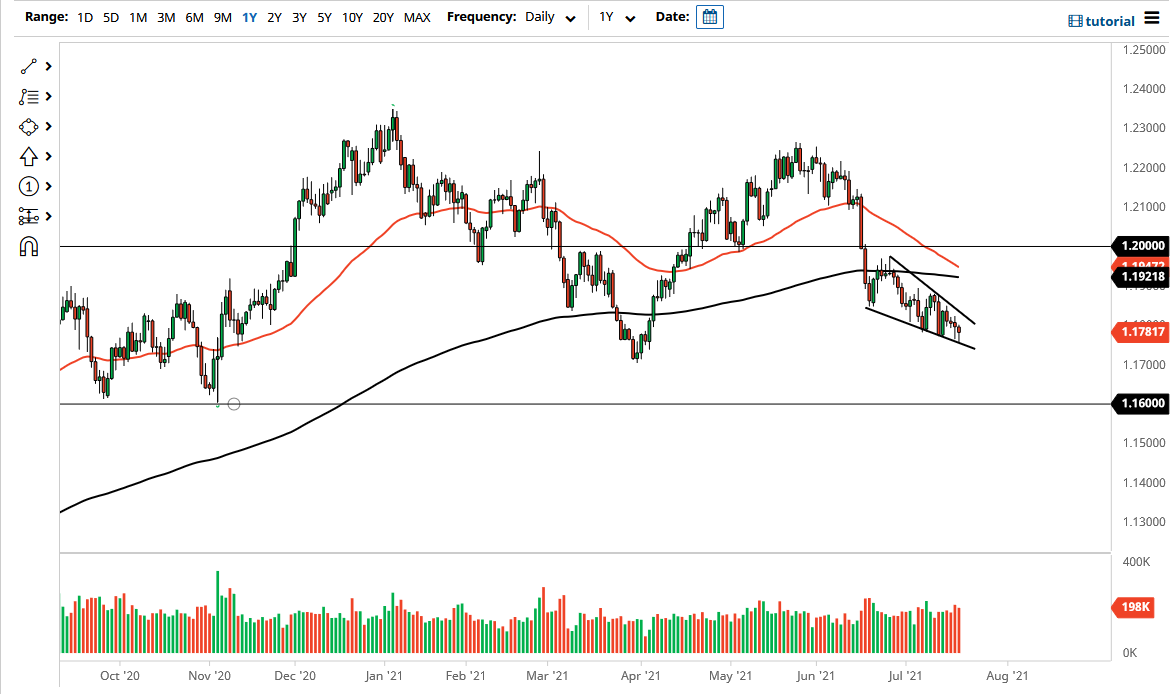

The euro fell again during the trading session on Tuesday to reach down towards the bottom of the same downtrend line that has been part of the descending channel. It is worth noting that the descending channel will use tightening, and it is possible that it is forming a technical pattern known as a “falling wedge.” If we break above the top of this wedge, it is a bullish sign and could send the euro higher.

On the other hand, if we break down below the bottom of the past couple of trading sessions, it is very likely that the euro would go much lower, perhaps reaching down to the 1.17 level, and then the 1.16 level after that. Ultimately, that is an area that is a significant support level in the past, so I think it should continue to be the way going forward. With this being the case, it is very likely that we will see a lot of volatility regardless, and I do think that there would be a huge fight on our hands closer to the 1.16 level.

For the rest of the week, I believe we will probably have somewhat quiet trading, but if we get an impulsive candlestick in either direction, it gives us an idea as to where to go next, because we are also getting close to a “death cross”, when the 50-day EMA drops below the 200-day EMA. That is a longer-term sell signal and does tend to open up the possibility of longer-term investors going short. That being said, I only put so much interest in the “death cross”, and think of it is more or less a tertiary indicator at best.

If we do get that breakout to the upside, I anticipate that the 200-day EMA, currently sitting at the 1.1921 level, could be difficult to get above. This is especially true considering that the 50-day EMA is coming into the same area as well. With all of that, I think the uptrend is probably somewhat limited, especially with the 1.20 level above being a major resistance barrier. It is not until we break above there that I would think the market would be in a longer-term uptrend, but the “falling wedge” targets the top of the pattern anyway, which kind of lines up in the same area overall.