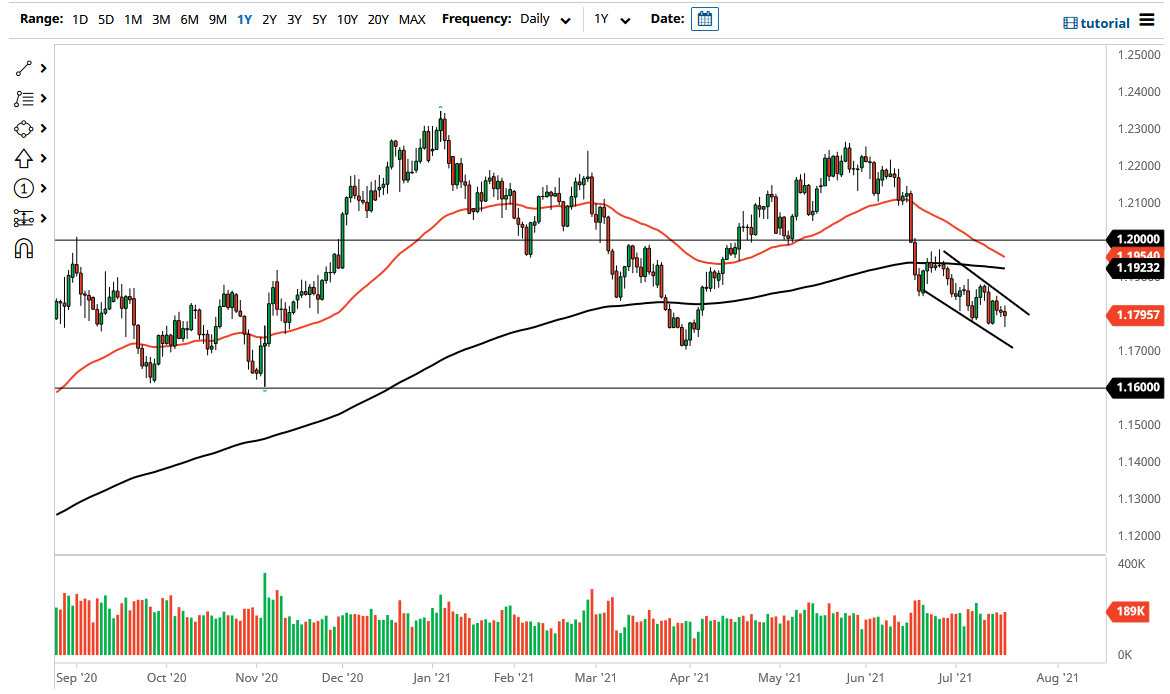

The US dollar was the star of the Forex world during the trading session on Monday as there was a major “risk off” situation during the session. That being said, the euro has turned around after significant losses, so I think at this point the euro will probably outperform a lot of the other major currencies, even if it does continue to drop against the greenback. Furthermore, when you look at the daily candlestick, it is a bit of a hammer, so it does suggest that perhaps we could get a little bit of a bounce.

At this point, it is also worth noting that we are in a bit of a significant channel, so you need to watch this chart closely, as that channel could continue to cause downward pressure. If we break down below the bottom of the candlestick for the trading session on Monday, then it is likely that we will drop to the 1.17 level, and then finally the 1.16 level based upon the longer-term technical analysis and the fact that the 1.16 level has been massive support more than once.

To the upside, if we can take out the 200-day EMA, then it is possible that we could reassert the bullish trade, but we are much closer to a “death cross” that we have been in a long time. The 50-day EMA is starting to reach towards the 200-day EMA, which forms that negative signal. Longer-term traders typically will look at that as a major selling signal. Whether or not that actually plays out is a completely different question, but it is obvious that there is a lot of negative pressure on this market, so I believe that rallies will continue to attract sellers, especially as soon as we see any hints of exhaustion. I do prefer selling short-term rallies, but this is a very choppy market under the best of circumstances, so I do not expect this market to be easy to trade for anything more than a short-term scalp. Keep in mind, it is the US dollar strengthening against most currencies that is what is driving the pair right now. Regardless, this is a market that will continue to be very choppy, so you will need to either be short-term focused or very small with your trading position.