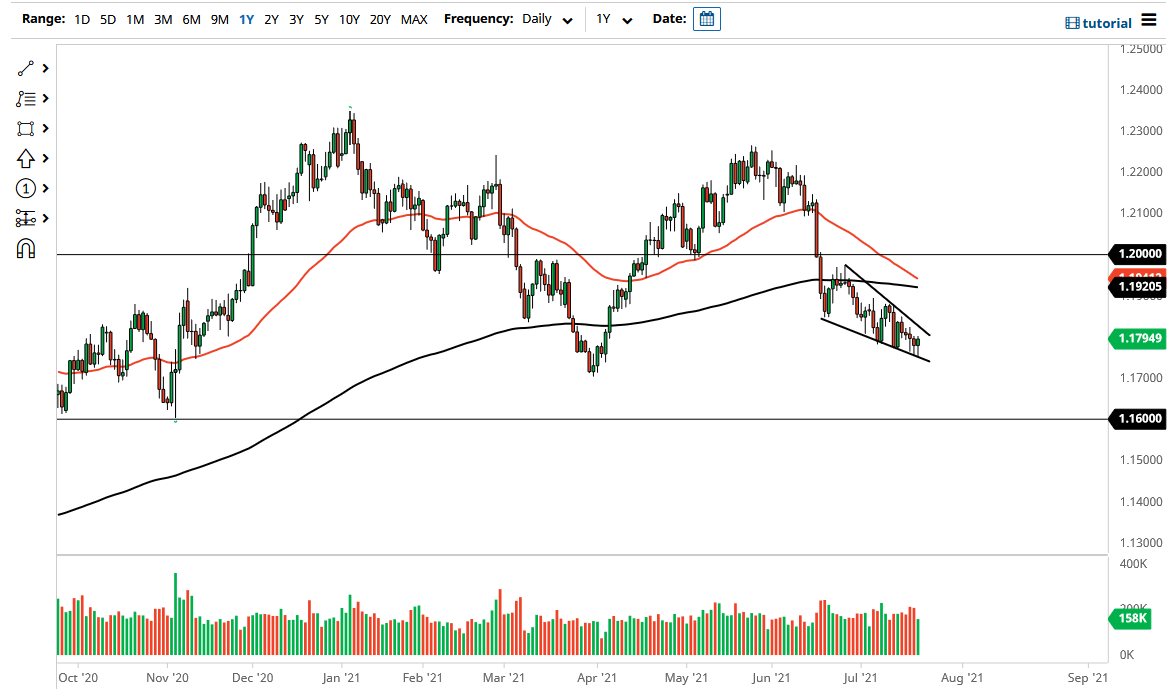

The euro initially fell during the trading session on Wednesday but found enough support in the same general region that we have over the last three days to make this market turn around. As we are closing towards the top of the range, that does suggest that we could go higher, and I think we will probably try to break out of this falling wedge. The falling wedge is a bullish formation, and it gives you an opportunity to go looking towards the highs of that pattern.

The 200-day EMA currently sits right around the 1.1920 level, where the 200-day EMA is starting to reach lower. If the 50-day EMA breaks down below the 200-day EMA, then it would form the so-called “death cross”, which is a longer-term selling signal for technical traders. I think at the very least we will probably get a bit of recovery due to the fact that the market simply has refused to fall significantly. With this being the case, I think a short-term buying opportunity could present itself, but if you are inclined to wait for the longer-term trade, it is probably above on signs of exhaustion.

Pay close attention to the 10-year yields, because if they start to rise again, it is possible that the US dollar would strengthen. However, we need to pay close attention to the markets' focus on the “risk on/risk off” attitude of traders around the world, so it is worth paying close attention to global indices and other such things to get a gauge on whether or not traders are feeling more comfortable. If indices around the world were to start rallying, then it is very likely that we would see the pair start to drift even lower. I think you will probably hear a lot of noise in this area, but I think longer term we are still going to go looking towards the 1.16 level given enough time. Ultimately, I think we are going to see a lot of noisy behavior more than anything else, so you need to be cautious about your trading position.