Bearish View

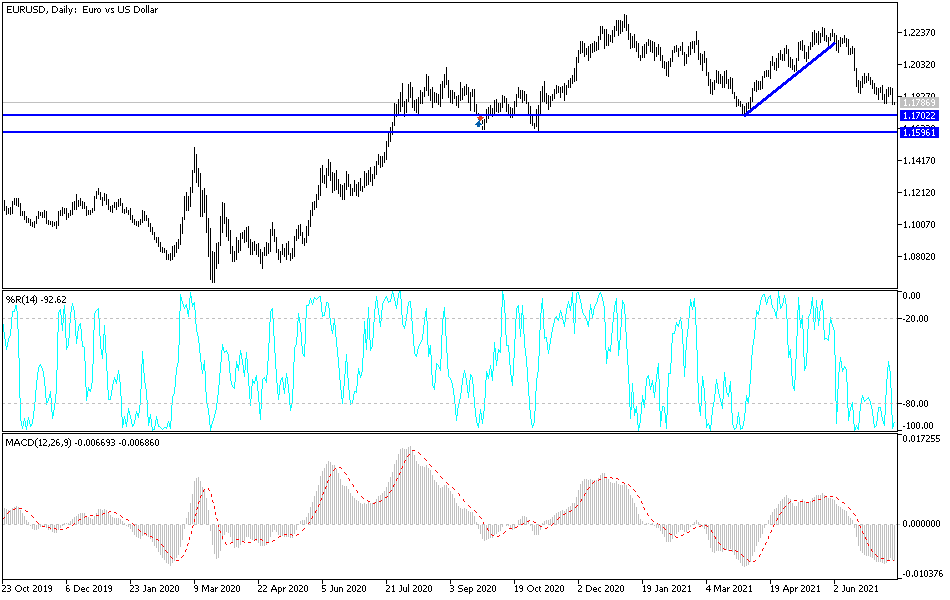

- Sell the EUR/USD and set a take-profit at 1.1700.

- Add a stop-loss at 1.1840.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.1800.

- Add a take-profit at 1.1870 and stop-loss at 1.1750.

The EUR/USD crashed to the lowest level since April this year after the strong US Consumer Price Index (CPI) data. It is trading at 1.1785, which is about 0.80% below its highest level last week.

US Inflation Puts Pressure on the Fed

The US published strong inflation data on Tuesday. The numbers revealed that the headline CPI rose from 0.6% in May to 0.9% in June. This increase, in turn, led to a year-on-year gain of 5.4%, the highest level since 2008. Core CPI, which excludes the volatile food and energy products, rose from 0.7% to 0.9%. It rose by 4.6% on a YoY basis.

This surge in inflation was attributed to several factors. For example, the chip shortage plaguing the auto industry has pushed prices of new and used cars up by more than 10%. At the same time, the rising commodity prices has pushed the prices of key items like housing and furniture substantially up. Gasoline prices have risen as crude oil has risen to the highest level in more than 5 years.

Above all, US inflation has risen because of the rising demand as the economy rebounds. Analysts expect that the economy expanded by more than 9% in the second quarter, the fastest increase since the 1980s. As such, the EUR/USD pair declined because the rising inflation will put more pressure on the Federal Reserve to start tightening. This will likely start with scaling down the quantitative easing purchases later this year.

The EUR/USD will today react to the latest US Producer Price Index (PPI) data. The numbers are expected to show that the PPI jumped in April as input prices rose. The pair will also react to the latest Fed Beige Book that will come out during the American session. Most importantly, it will react to a statement by Jerome Powell, the Fed chair.

EUR/USD Technical Analysis

The four-hour chart shows that the EUR/USD pair declined sharply after the latest US inflation data. It fell to 1.1770, which was the lowest level since April. It has also moved below the short and longer moving averages and the important support at 1.1800. The RSI and MACD have also declined. Therefore, the path of least resistance for the pair is to the downside. The next key level to watch will be the psychological level at 1.1700.