Bullish View

Buy the EUR/USD and add a take-profit at 1.1950.

Add a take-profit at 1.1750.

Timeline: 1 day.

Bearish View

Set a sell-stop at 1.1750 and add a take-profit at 1.1600.

Add a stop-loss at 1.1850.

The EUR/USD pair tilted upwards during the overnight session after the mixed US consumer confidence and durable goods orders data. It rose to 1.1836, which was slightly higher than this week’s low of 1.1755.

Mixed US Data Ahead of Fed

Consumer confidence in the US bounced back in July even as the Delta variant spread in most cases. According to the Conference Board, consumer confidence rose from 128 in June to 129.1 in July. This increase was better than the median estimate of 123. While the number of COVID cases is rising again, consumers are generally confident about their job prospects as more companies reopen.

Meanwhile, hard data showed that durable goods growth was relatively muted in June. The core durable goods orders rose by 0.3% in June after rising by 0.5% in the previous month. In total, durable goods orders rose by 0.8%, which was a significant drop from the previous 3.2%. Without defense and air, goods orders remained at 0.5%.

The biggest catalyst for the EUR/USD will be the Federal Open Market Committee (FOMC) decision that is scheduled for later today. Economists expect that the Fed will sound cautious because of the new COVID wave. As such, the bank will likely maintain its cautious outlook of the American economy. Furthermore, the CDC has already issued a mask mandate and there is a possibility that some lockdowns will return.

Therefore, while this meeting was supposed to be about tapering, many analysts expect that Jerome Powell will sound neutral to hawkish. Furthermore, the new wave will likely lead to lower inflation in the near term. Indeed, the so-called inflation expectation has dropped while the 10-year Treasury yield has dropped to the lowest level since January. Some analysts expect that the bank will start tapering later this year or in 2021.

EUR/USD Technical Analysis

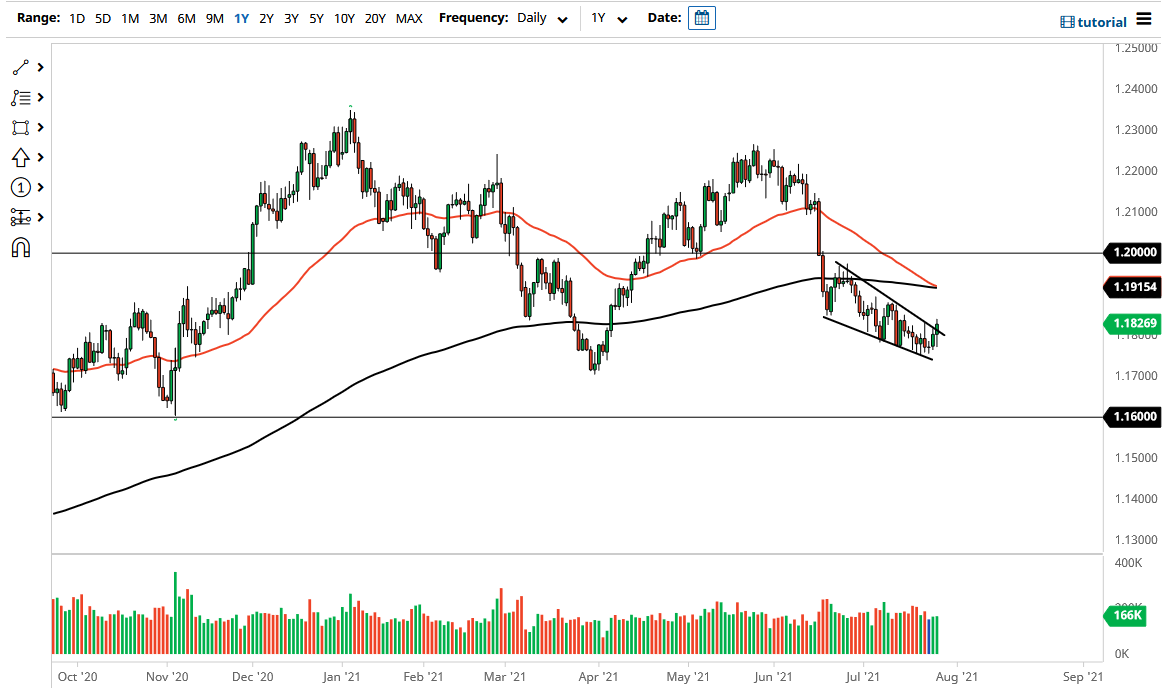

The three-hour chart shows that the EUR/USD pair has been in an overall bearish trend in the past few weeks. Along the way, it has formed a falling wedge pattern that is shown in black. This pattern is usually a bullish sign. In fact, it has already moved above the upper side of the wedge. The pair has also risen above the 25-day and 50-day moving averages while the MACD has moved above the neutral level. Therefore, the pair will likely maintain the bullish trend as bulls target the next key resistance at 1.200.