Bullish View

Set a buy-stop at 1.1800 and a take-profit at 1.1900.

Add a stop-loss at 1.1720.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1750 and a take-profit at 1.1650.

Add a stop-loss at 1.1800.

The EUR/USD price was little changed in early trading as investors refocus on the upcoming Federal Reserve interest rate decision. The pair is trading at 1.1776, where it has been in the past few weeks.

ECB and Fed Decisions

The EUR/USD reacted mildly to the relatively dovish ECB interest rate decision last week. In it, the bank decided to leave interest rate unchanged. It will also continue with its 1.85 trillion euros asset purchases in a bid to stimulate the economy. Still, the dovish tone found some resistance from several committee members including those from Germany, Belgium, and the Netherlands.

The biggest catalyst for the EUR/USD this week will be the Fed interest rate decision that will come out on Wednesday. The bank is also expected to leave interest rates unchanged at the range of 0% and 0.25%. It is also expected to maintain its asset purchase program. The new COVID wave will likely give it cover to maintain a dovish tone.

Today, traders will react mildly to the latest German business expectations data. Economists expect these numbers to show that business expectations declined from 104 to 103.3 as fears of coronavirus remained. They also expect the current assessment among business leaders increased from 99,6 in June to 101.6 in July. The business climate is expected to move from 101.8 to 102.1.

These numbers will come at a time when there are worries that Germany will soon go back put curbs on the unvaccinated. In a statement, Helge Braun, Chancellor Angela Merkel's chief of staff, said that these restaurants will likely be introduced in restaurants, cinemas, and stadiums. This could slow down the country’s recovery from the pandemic.

The EUR/USD will also react mildly to the latest new home sales numbers. Analysts expect that sales rose by 3.5% in June after falling by 5.9% in the previous month.

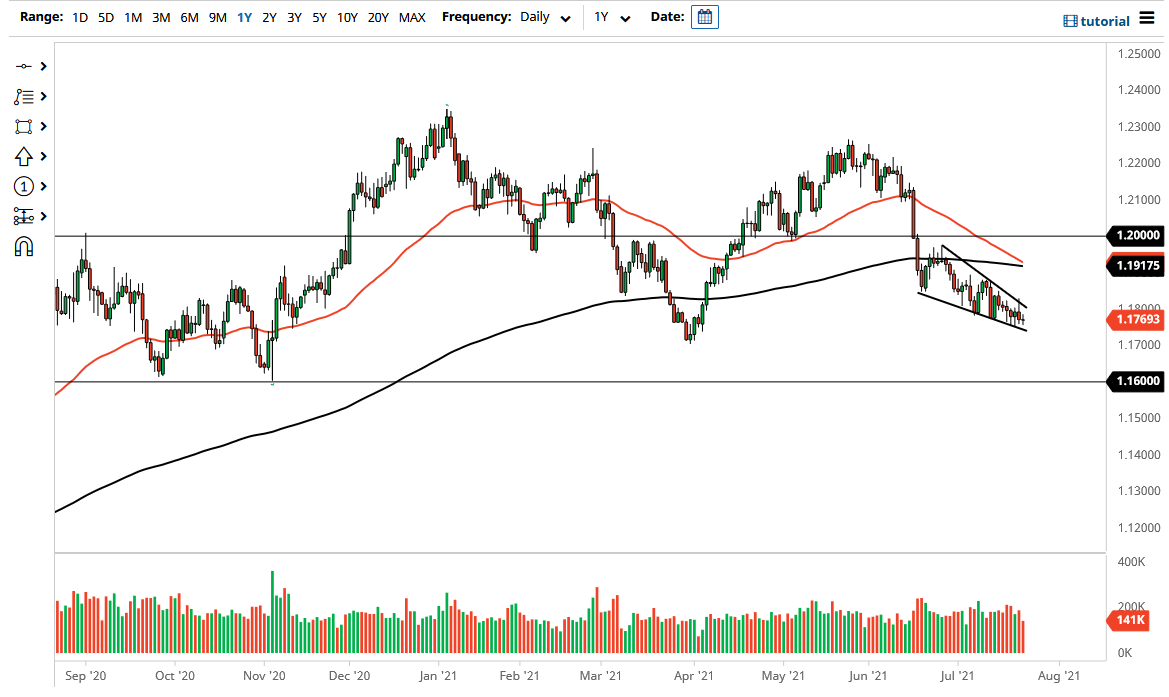

EUR/USD Technical Analysis

The EUR/USD has been in a tight range recently. It is trading at 1.1775, where it has been in the past few days. Along the way, the pair has formed a falling wedge pattern, which is usually a bullish sign. It also moved below the 25-day and 15-day moving averages while the Relative Strength Index (RSI) is at the neutral level of 48. Therefore, the pair will likely see a strong rebound later this week.