Bearish View

- Sell the EUR/USD and set a take-profit at 1.1750.

- Add a stop-loss at 1.1870.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.1850 and a take-profit at 1.1900.

- Add a stop-loss at 1.1800.

The EUR/USD pair was little changed during the American session as investors watched the US Treasury bond market ahead of the latest FOMC minutes. The pair is trading at 1.1823, which is about 0.60% below the highest point on Tuesday.

US Bond Yields Drop

US government bonds rally accelerated ahead of the latest FOMC minutes. The yield of the ten-year yield declined to 1.36%, its lowest level in four months. It was the first time that the yield has moved below 1.40% since February. This is substantially lower than this year’s high of 1.77%.

US bonds rally accelerated after the mixed employment numbers published on Friday. The data revealed that the US added more than 850,000 jobs in June while the unemployment rate rose to 5.9%. As such, investors believe that the non-farm payrolls will not help shift the Fed’s sentiment about the market.

The bonds and the EUR/USD also reacted to the latest Services PMI data by the Institute of Supply Management (ISM) and Markit. The numbers showed that activities in the sector weakened slightly in June. This decline was partly because of the challenges of finding qualified workers.

Traders will today focus on the latest minute by the Federal Open Market Committee (FOMC). The minutes are expected to provide more details about what the committee members said in the meeting held three weeks ago. In it, they decided to leave interest rates unchanged and hinted that they will start hiking rates in 2023.

The EUR/USD will also react to hard data from Germany. The country’s statistics agency will publish the latest industrial production data that is expected to increase from -1.0% to 0.5%. The data will provide a picture of the country’s recovery.

EUR/USD Technical Analysis

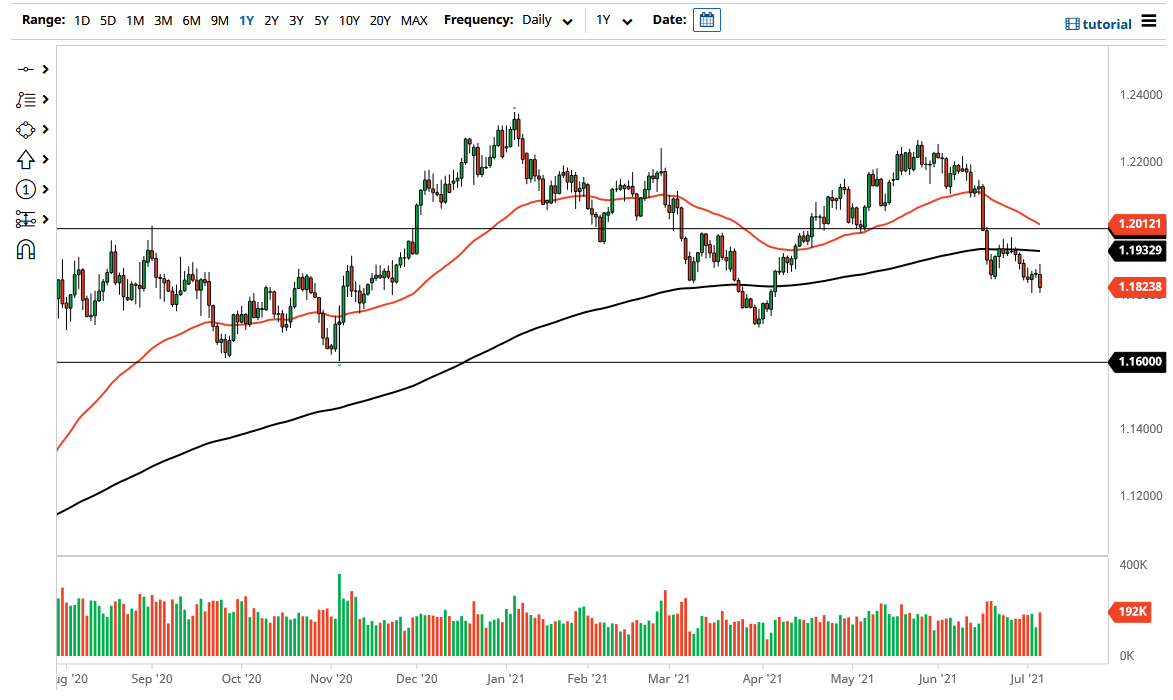

The EUR/USD declined to a low of 1.1800 on Tuesday. This price is about 1.27% below the highest point last week. It was also below the important support at 1.1847. The pair has also moved below the 25-day and 14-day volume-weighted moving average (VWMA).

It has also formed an inverse cup and handle pattern that is usually a sign of continuation. Therefore, the pair will likely resume the downward trend as bears target the next key support at 1.1750. However, a move above the resistance at 1.1.1900 will invalidate this prediction.