Bearish View

- Set a sell-stop at 1.1847 and a take-profit at 1.1760.

- Add a stop-loss at 1.1900.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.1875 and a take-profit at 1.1950.

- Add a stop-loss at 1.1800.

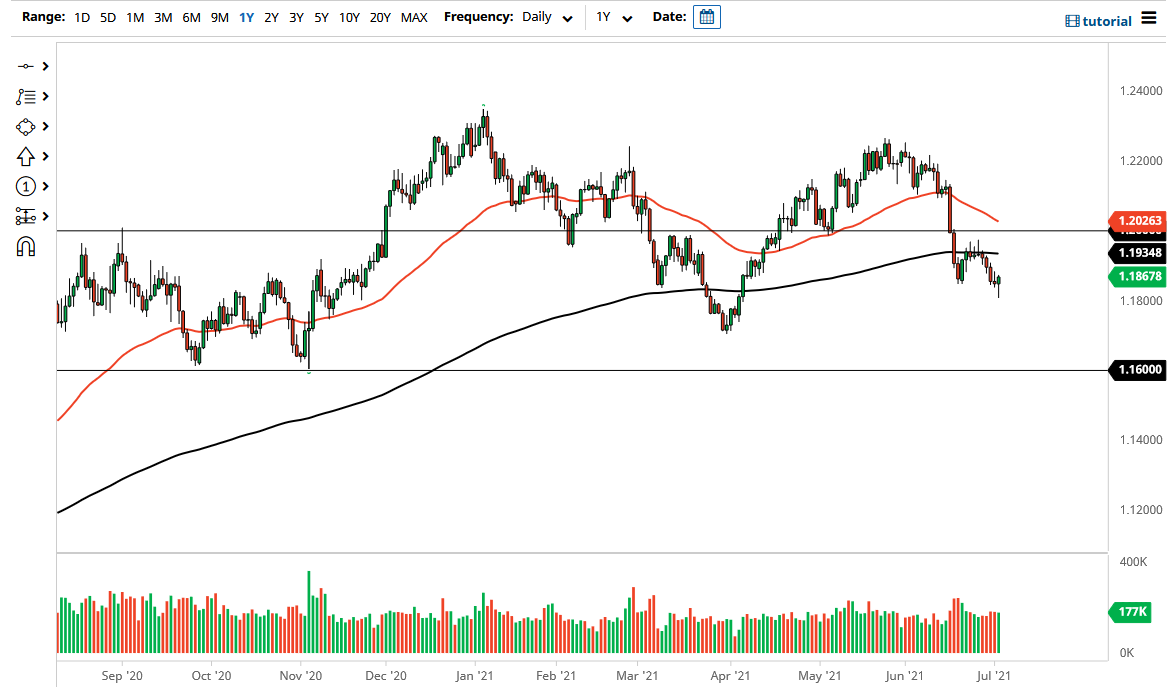

The EUR/USD wavered during the Asian session ahead of a relatively low-volume day as the US celebrates Independence Day. The pair is trading at 1.1857, which is slightly above last week’s low of 1.1807.

Eurozone PMI Ahead

The EUR/USD is in a tight range as investors continue reflecting on the latest US non-farm payrolls data. The numbers showed that the US labour market was still tightening as the economic recovery continued.

The economy added more than 850,000 jobs in June after adding less than 600k a month earlier. The participation rate and wages also increased, albeit at a slower pace. Data published earlier on showed that the number of Americans applying for initial jobless claims fell to the lowest level since the pandemic started. Further data by Challenger revealed that the number of layoffs in the country dropped to 20k from the previous 26k.

These numbers show that the American economy is doing relatively well as companies struggle to find workers. Some of the biggest employers like restaurants and airlines have already added salaries to attract new workers. As such, with inflation also rising, the Federal Reserve will likely be under pressure to maintain its recent hawkish tone.

The EUR/USD will react mildly to the latest European Services PMI data. The numbers are expected to show that the Services PMI in the Eurozone declined slightly to 58. In Germany, it is expected to reduce to 58.1 while in Italy it is expected to increase to 56.0. A PMI reading above 50 is a sign that an industry is expanding.

The biggest challenge facing Europe is that of the new wave. In a report last week, the World Health Organization (WHO) warned that complacency will likely lead to a new wave in Europe. The statement came a few days after some countries announced some travel limits.

EUR/USD Forecast

The EUR/USD pair is trading at 1.1853, which is slightly above last week’s low at 1.1800. On the two-hour chart, the pair has formed what looks like an inverse cup and handle pattern. It is also at the same level as the 25-day and 15-day exponential moving average (EMA). Therefore, the pair will likely remain at this range today and then resume the downward trend later this week. If this happens, the next key level to watch will be moves below 1.1800.