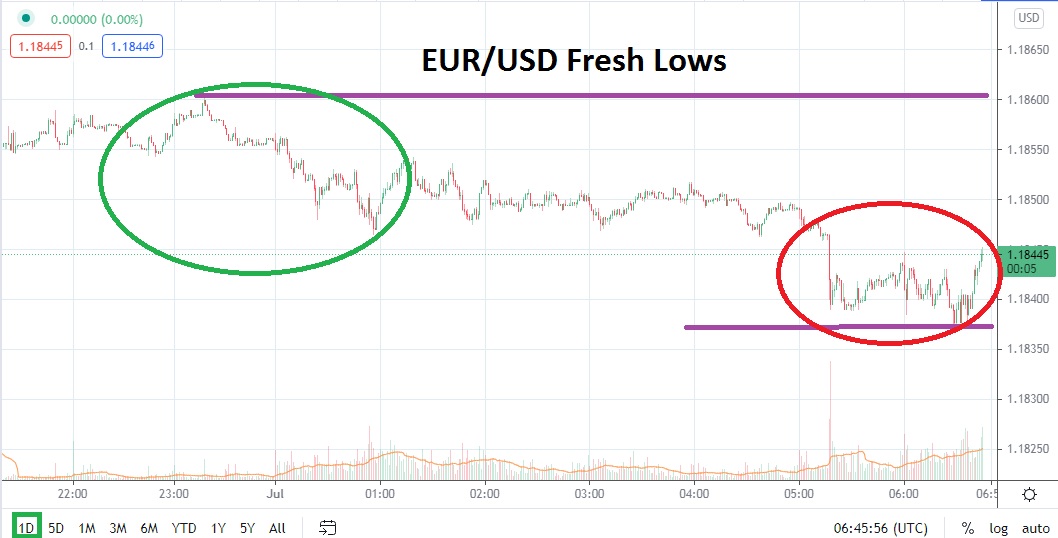

In early trading today, the EUR/USD has broken through support ratios created on the 21st of June. As of this writing, the EUR/USD is trading near the 1.18455 mark with fast conditions prevalent as financial institutions and their programmed trading resources react to current values. Short-term traders have an intriguing decision to make regarding direction.

On the 16th of June, the EUR/USD was trading near the 1.21100 level, before the U.S Fed’s FOMC Monetary Policy Statement created chaos in Forex. By the 21st of June, the EUR/USD essentially achieved a low around 1.18420, which is where the Forex pair is more or less trading as of this morning. The week of trading, which has been demonstrated since reaching the lows on the 21st, have also produced an interesting ride and test for speculators. On the 25th of June, the EUR/USD climbed to a high of nearly 1.19750, but since then has incrementally seen bearish pressure mount.

As the EUR/USD trades near important mid-term support this morning, bearish traders may be contemplating the lows of early April 2021. The value of the EUR/USD puts it within early April technical considerations, but interestingly the prices seen then were being created as the EUR/USD was in the midst of a bullish movement. This after a low of nearly 1.17000 was attained in late March.

While lower values of the EUR/USD are evident via six-month charts, the questions begs if the Forex pair is actually going to traverse those lower depths again in the near term. After touching values near the 1.21100 mark only a couple of weeks ago, some speculators may believe the EUR/USD has been oversold and its downside momentum has been an overreaction.

Aggressive traders who want to wager on a bullish reversal emerging in the short term cannot be faulted. Yes, the short-term trend has certainly been negative for the EUR/USD, but perhaps the bearish move has been too fast. Buying the EUR/USD on small reversals lower within its current price range may prove tempting and worthwhile for speculative bulls at the depths being demonstrated. Yes, there will be a jobs report from the U.S also on Friday, which will certainly affect the EUR/USD in the short term. Traders need to be alert and use their risk management wisely the next two days.

EUR/USD Short-Term Outlook:

Current Resistance: 1.18600

Current Support: 1.18270

High Target: 1.18950

Low Target: 1.18120