In the last two trading sessions of the past week, the EUR/USD currency pair attempted to correct upwards, after selling operations that pushed it towards the 1.1781 support level, the lowest in three months. The rebound attempts pushed the currency pair towards the 1.1881 level on Friday, which closed the week's trading near it. The euro's gains may face renewed fears of the rapid spread of the Corona virus, which is a threat to the efforts of countries to fully reopen.

From Europe, the closely watched infection rate per 100,000 residents in Spain rose to 316, from a 2021 low of 92 cases on June 22. In a departure from previous increases, and before vaccines are available, new deaths recede and hospital occupancy rates grow at a fraction of the pace of new infections. For example, on Friday, the Spanish Ministry of Health reported 6 confirmed deaths nationwide, the lowest number since last summer, compared to 352 on January 5 this year and 217 on October 19 last year, two dates when the infection rate was at similar levels and on the rise. More than a tenth of regular hospital beds and a fifth of intensive care departments were treating COVID-19 patients at the time, but the current occupancy rate is 2.4% in regular beds and 6.6% in intensive care units.

There is a similar pattern in other countries with the fastest outbreaks in Europe. In Portugal and Cyprus, hospitals are still far from previous scenarios of near collapse, although they are steadily accumulating patients. The number of new infections reported in the UK averaged around 30,000 per day last week, compared to a peak of about 70,000 at the height of the winter wave in January driven by the alpha variant - more contagious than the original virus but much lower than the delta variant. The daily deaths at that time exceeded 1,000 deaths for a day, while 29 were recorded on Friday.

The Fed's stance is in marked contrast to that of the European Central Bank (ECB) which announced last week that it would tolerate inflation above 2.0%, an indication that some in the market are pointing to a lower interest rate regime for a longer duration in Europe. Thus, the difference will eventually create a headwind for the exchange rate between the euro and the dollar. The new ECB strategy could lead to a longer period of lower interest rates and quantitative easing (QE) with similar market effects to those of the Federal Reserve, although it could be better understood as a reversal after the bank learned ECB from the mistakes of the past.

European central bankers agreed and voted to raise their inflation target from a slightly ambiguous level "below 2% but close to 2%" to exactly 2% after the first review and overhaul of monetary policy strategy since 2003.

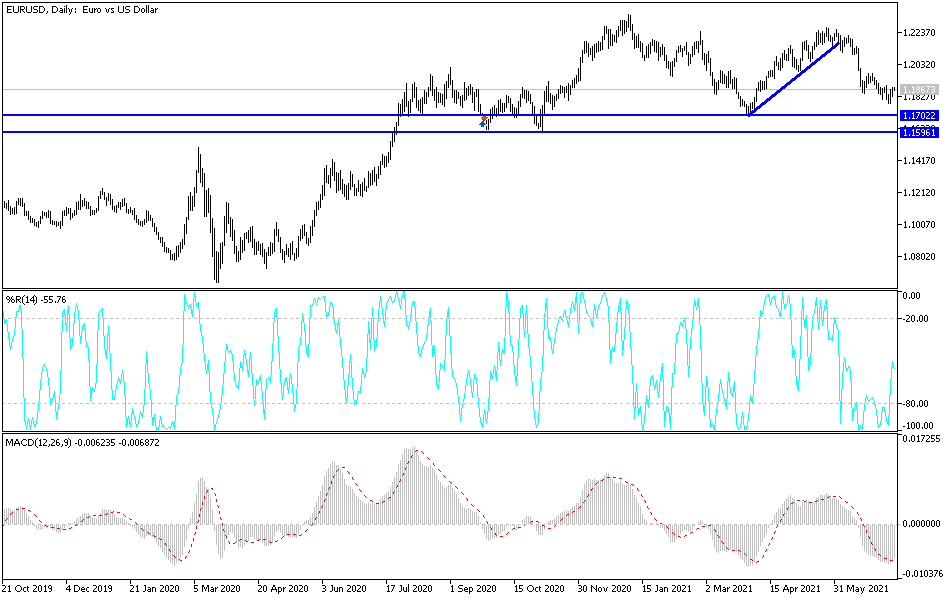

According to the technical analysis of the pair: On the chart of the four-hour time frame, the price of the currency pair EUR/USD started forming an upward correction channel. To strengthen the rebound, it is necessary to break through the 1.2000 psychological resistance, which may increase the buying transactions for the EUR/USD. This paves the way for an exit from the bearish outlook which still dominates the performance of the pair in the long run. So far the 100 SMA is still below the 200 SMA to confirm that the general trend is still down.

On the 1 hour chart, the 200 SMA held as dynamic resistance at the top of the channel and could continue to hold as a ceiling. Hence, EURUSD could fall back to the swing low around 1.1780 or the channel bottom. The 38.2% Fibonacci extension is located at 1.1824 and then the 50% level near the important channel mid-zone at the key psychological support 1.1800. The 61.8% extension at 1.1796 then the full extension near 1.1750. Stochastic is heading lower but falling into oversold territory to indicate exhaustion. A return to the upside could mean that buyers are taking over and may try to break through the top of the channel. The RSI has more room to go lower, which indicates that the bears could stay in control for a bit longer.

With the start of this week's trading, the euro will be on a new date with statements by ECB Governor Lagarde, and no major shifts in policy bias are expected, as the central bank may take some time before reducing its stimulus efforts.