Despite the European Union’s approval of more stimulus plans to counter the effects of the pandemic, the currency pair EUR/USD suddenly experienced selloffs that pushed it from the resistance level of 1.1875 to the support level of 1.1772, its lowest in three months.

It is stable around the 1.1790 level at the time of writing the analysis. A reaction is waiting on the testimony of US Federal Reserve Governor Jerome Powell later in the day. Yesterday, a further rise in US inflation was announced, which increases expectations that the date for raising US interest rates is imminent, and that the bank's view is correct.

More bearish momentum is expected for the EUR/USD, especially if today's testimony from US Federal Reserve Governor Jerome Powell supports the idea that the bank is likely to cut 120 billion per month from its quantitative easing program and raise interest rates sooner than previously suggested.

Commenting on the performance, Goldman Sachs FX Analyst Zach Bandel said, “We believe EUR/USD should remain range bound in the near term, possibly with a bearish bias given the confirmation in the FOMC Minutes that the tightening schedule sensitive to higher than expected inflation. "We continue to expect the EUR/USD to drift higher towards the end of the year as global growth levels and the European Central Bank take their own steps towards curtailing bond purchases," Bandel adds in a research note.

If high or rising inflation leads the market to favor the idea that price growth is less transitory than the Federal Reserve envisions, and that the average inflation target of 2% is likely to be achieved sooner than previously thought, this could increase demand for the dollar and test Euro flexibility. Likewise with Federal Reserve Chair Jerome Powell's testimony on Wednesday to Congress, although technical analysts at Commerzbank say the Euro is benefiting from technical support around 1.1777 and that any downside we see over the coming days is likely to be limited.

“On the daily chart, the rallies are being referred to as corrective only and you should struggle around 1.1880/1.1945,” says Axel Rudolph, chief technical analyst at Commerzbank. “We note the 1.1777 support line below the market and are currently looking for a recovery. "We think the downside is actually very limited," adds Rudolph.

Rudolph and the Commerzbank team pointed to the negative divergence between the EUR/USD exchange rate and the RSI, as the RSI indicated a higher potential reversal by the Euro, to anticipate a recovery that has occurred so far at the beginning of this week's trading.

European Union countries approved pandemic recovery plans for the bloc's four largest economies and eight other member states on Tuesday, in a move seen as pioneering the economic recovery from the unprecedented recession caused by the coronavirus pandemic. The approval would allow dozens of the EU's 27 members to begin freeing up funds to pre-finance projects aimed at putting Europe on a more solid economic footing while making it greener and more digitally advanced.

The countries include the major economic powers of the European Union - France, Germany, Italy and Spain - and Austria, Belgium, Denmark, Greece, Latvia, Luxembourg, Portugal and Slovakia.

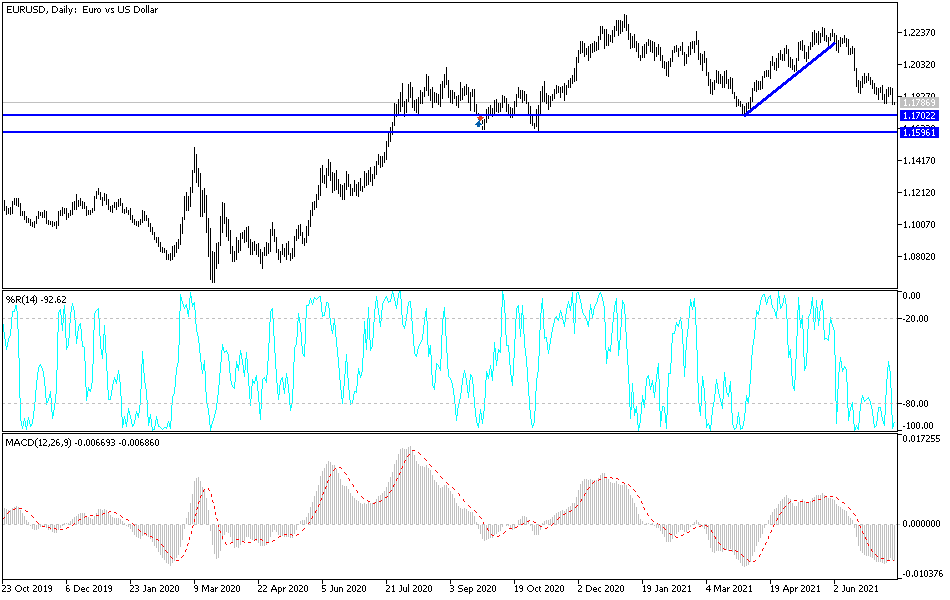

According to the technical analysis of the pair: On the daily time frame chart below, the price of the EUR/USD currency pair is still in a downward correction stage, and the move towards the 1.1770 support level pushes the technical indicators to strong oversold levels, which gives pause for Forex investors who consider buying the pair. The closest support levels currently for the pair and the most important to think about are 1.1745, 1.1680 and 1.1600, respectively. On the upside, and as I mentioned before, there will not be a chance for a new bull’s domination without breaching the 1.2000 psychological resistance level, which will stimulate more buying technically to exit the current descending channel.

As for the economic calendar data today: The euro will be affected by the announcement of the industrial production rate in the euro area, and the US dollar will be affected by the announcement of the PPI reading and the reaction from the testimony of Federal Reserve Governor Jerome Powell.