The increase in European Coronavirus infections weakened the attempts of the EUR/USD to correct its highest, as its gains during last week’s trading did not exceed the 1.1875 level. The lowest was 1.1771 during the same week, before closing trading stable around the 1.1805 level, amid a stronger control of the bears on the performance. In light of the growing concern, European countries are seeking to intensify vaccination campaigns, using the carrot and stick approach to convince the hesitant to get their doses because the more transmissible delta alternative leads to an increase in infection.

Greece became the latest to impose new restrictions on Friday, requiring proof of vaccination or a recent recovery from COVID-19 to access indoor restaurants, cafes, bars, and cinemas. Children may enter negative tests. The measure, part of a government stimulus package, has had little immediate effect given that nearly all public life moves outdoors during Greece's hot, dry summers. Sidewalk cafes, restaurants, and outdoor cinemas remain accessible to all.

Once the measure went into effect in Greece, the Russian capital scrapped a similar measure that had been introduced last month. Moscow Mayor Sergei Sobyanin announced that restaurants should only accept customers with evidence of vaccination or a negative test on Monday as the pace of infection slowed. The restrictions have hit restaurant owners, already suffering from the impact of the pandemic, hard, forcing many to close.

Some European countries have also introduced mandatory vaccinations for some professions. Italy made vaccinations mandatory in April for healthcare workers and pharmacists. France and Greece announced mandatory vaccinations this week for healthcare workers and care home staff, with France extending the requirement to those caring for the elderly or sick at home. France also announced mandatory COVID-19 entry cards for access to restaurants, bars, shopping malls and many tourist sites, as well as trains and planes, from July 21.

On Friday, the US retail sales watchdog group for June posted a better-than-expected change of 1.1% compared to 0.4%. The general retail sales for the month outperformed the expected change (MoM) by -0.4% with a change of 0.6%. On the other hand, non-auto retail sales beat expectations by 0.4% with 1.3% (MoM).

Elsewhere, the Michigan Preliminary Consumer Confidence Index for July missed expectations at 86.5 with a reading of 80.8. Prior to that, the Philadelphia Fed Manufacturing Survey for July missed expectations, while both PPI and CPI beat expectations.

From the EU, the Eurozone (core) CPI for June matched the expected (monthly) and (annual) changes of 0.3% and 0.9%, respectively. The general CPI for months also matched expectations (MoM) at 0.3%. Prior to that, the EU's seasonally adjusted industrial production for May missed the expected change (MoM) at -0.2% with -1% change.

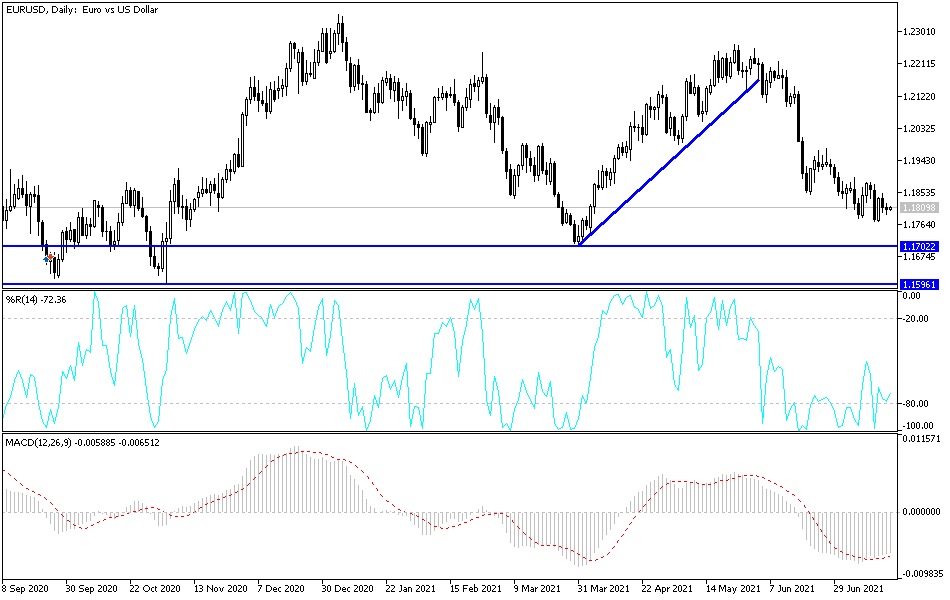

According to the technical analysis of the EUR/USD: In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a slight short-term bearish momentum in the market sentiment. Accordingly, the bulls - the bulls - will target short-term rebound profits around 1.1837 or higher at 1.1873. On the other hand, the bears will look to make profits around 1.1773 or lower at 1.1735.

In the long term and according to the performance on the daily time frame, it appears that the EUR/USD currency pair is trading within the formation of an ascending channel. This indicates a slight long-term bullish momentum in the market sentiment. Accordingly, the bulls will look to ride the current trend by targeting the retracements at around 1.1955 or higher at 1.2147. On the other hand, the bears will target further declines around 1.1622 or lower at 1.1438.