For five trading sessions in a row, the price of the EUR/USD currency pair is trying to exit the descending channel, which pushed it towards the 1.1752 support level. The rebound attempts did not exceed the 1.1841 resistance level before settling around the 1.1810 level at the time of writing the analysis. This is at a time when the forex market is awaiting today’s announcement of Federal Reserve monetary policy decisions and the announcement of the US economic growth rate tomorrow. The reaction is strong and influential and may determine the course of the currency pair for the end of trading for this week.

The exchange rate from the euro to the dollar gained momentum despite the fears of the Corona variable. This is as global stock markets were negatively affected by the decline in Chinese indices, which was reflected in the trend of the famous currencies traded recently. The Eurozone has some of the lowest interest rates in the world, and this makes the Euro an option as a “funding currency” for traders whenever they want to bet on gains in the value of other currencies. This has another aspect that tends to take advantage of currencies with lower interest rates such as the euro, the franc and the yen during periods of market turmoil.

The financing process sees the euro being borrowed and sold against the dollar before the dollar itself is swapped for the intended currency at the other end of the trade. This is why the euro often pulls back against currencies like the New Zealand dollar and the krone in periods when global markets are up and happy investors are taking risks. Risk appetite was the last thing investors seemed to do and they were happy yesterday, which saw all major stock markets fall across the globe except for those of Australia. With concurrent losses of risky currencies like the kiwi and the krone which seemed to benefit the EUR. Even as losses mounted for benchmark indices on the continent, a decline of more than -1% was seen for the Portuguese, Spanish and Danish stock indices.

Commenting on the performance of the euro-dollar. “Tactically, we would need to see a break above the 1.1882-1.1896 pivots to signal that a trend reversal is taking hold,” says Jason Hunter, technical analyst at JPMorgan. The main resistance in the short term is 1.1976 post-June FOMC meeting high and the confluence of the 50 day, 100 day and 200 day moving averages at 1.1979-1.2007. We believe the initial bounce will struggle at those levels.”

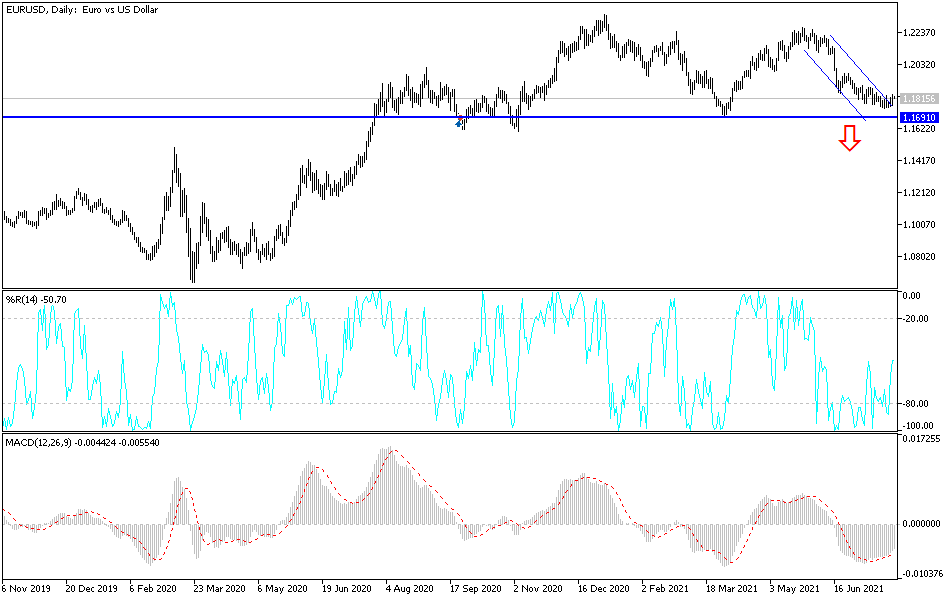

According to the technical analysis of the pair: As shown on the daily chart, the price of the currency pair EUR/USD is trying to exit the bearish channel that was formed recently. I see that the strong bullish reversal will only be achieved by testing the psychological resistance 1.2000. The current situation is still the strongest towards the downside again, especially if the bears in the pair return to the support levels 1.1765 and 1.1680 again. The reaction of the US Central Bank’s announcement, the statements of its governor, Jerome Powell, and the interaction of the markets with any indications about the date of tightening the monetary policy of the bank will have a strong and direct reaction on the pair. Caution should be taken until the decisions are recognized.