It was stable at the time of writing the analysis, with investors’ cautious anticipation of important influential data. The US dollar is still the strongest with expectations of raising US interest rates. The improvement in the results of the recent economic data increases the momentum of its gains.

On the European front, official data showed that Germany's unemployment rate fell to 5.7% in June with Europe's largest economy benefiting from a sharp drop in coronavirus infections.

The Federal Labor Agency said the unadjusted unemployment rate, the main figure in Germany, fell from 5.9% in May. The total number of people registered as unemployed was 2.61 million - 73,000 less than the previous month and 239,000 fewer than the previous year. In seasonally adjusted terms, the nation's unemployment rate remained at 5.9%, but there was a better-than-expected drop of 38,000 in the number of people considered unemployed. COVID-19 cases have fallen to their lowest level in months in Germany, allowing authorities to lift many restrictions - although they remain wary of the potential impact of the most contagious delta variant, whose share of new infections has risen rapidly.

The increase in unemployment in Germany and elsewhere in Europe has been moderate by international standards during the pandemic. This is because employers have made extensive use of payroll support programs, often referred to as vacation schemes, which allow them to keep employees on the payroll while they wait for better times. In Germany, the Employment Agency pays at least 60% of the salaries of employees who work reduced or zero hours.

The labor agency said it paid subsidies to 2.34 million people in April, the latest month for which it has an estimate. That was down from 2.7 million in March and well below a peak of around 6 million in April 2020. Commenting on the figures, Carsten Brzeski, an economist at ING, wrote in a research note: “At first glance, today's numbers suggest that the German labor market has left Already the crisis is behind him. However, at second glance, the large number of workers working short periods should remain a good reminder of the potential risks ahead, even if those risks seem less threatening by the month.”

The US dollar ended June's trading in an uptrend and is the closest as best performing currency for this month. A performance that leads to a noticeable turnaround given the declines that occurred during the year to June. In this regard, says Chris Beauchamp, Senior Market Analyst at IG, speaking on the main global currency topic, “The strength of the dollar is creating shocks in the markets.” He added, “Money continues to flow into the US dollar, as the dollar continues to recover from last week’s lows. The positive outlook for the United States is leading to a renewed rally in US assets, even if the Fed manages to muddy policy thanks to the recent FOMC meeting and the speeches that followed.”

The US Federal Open Market Committee (FOMC) meeting in June saw policy makers signal that the first interest rate timing in the post-Covid era is likely to come in 2023, a shift from earlier expectations of a hike in 2024.

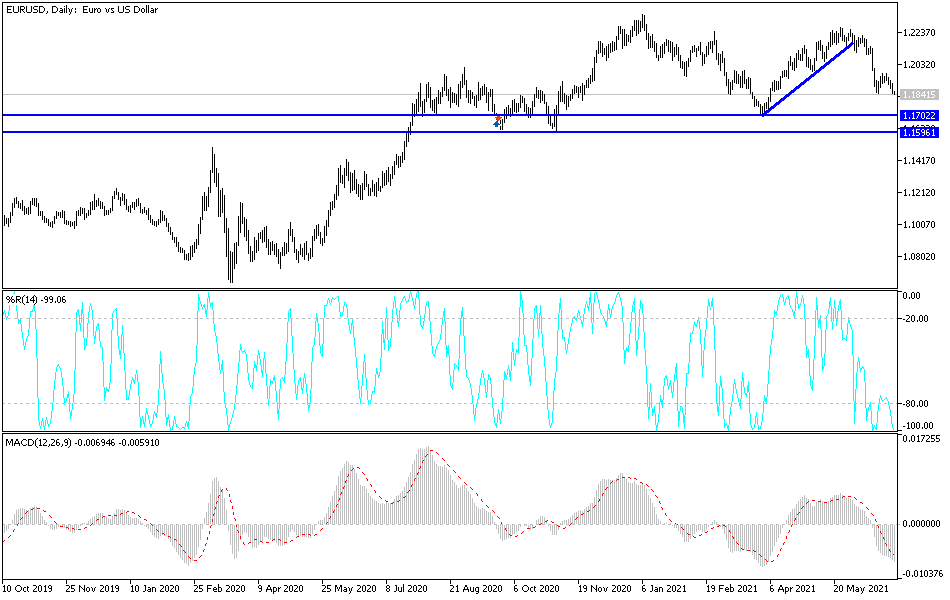

According to the technical analysis of the pair: The bears’ control over the performance of the EUR/USD currency pair will increase as long as it moves stable below 1.2000. There is room for the bears to move towards stronger descending levels, and the closest to them are currently 1.1810, 1.1755 and 1.1690, respectively. The second and third most important level for forex traders to think about buying the pair, waiting for the moment of the rebound up. The currency pair may remain under downward pressure until the US job numbers are announced tomorrow. Their results determine the fate either to continue the current situation or find an opportunity to compensate for losses.

There will be no chance for the bulls to control performance again without stability above the resistance 1.2000.

The euro will be affected today by the announcement of the manufacturing purchasing managers index and the unemployment rate in the eurozone. The US dollar will be affected by the announcement of the weekly jobless claims and the ISM manufacturing PMI reading.