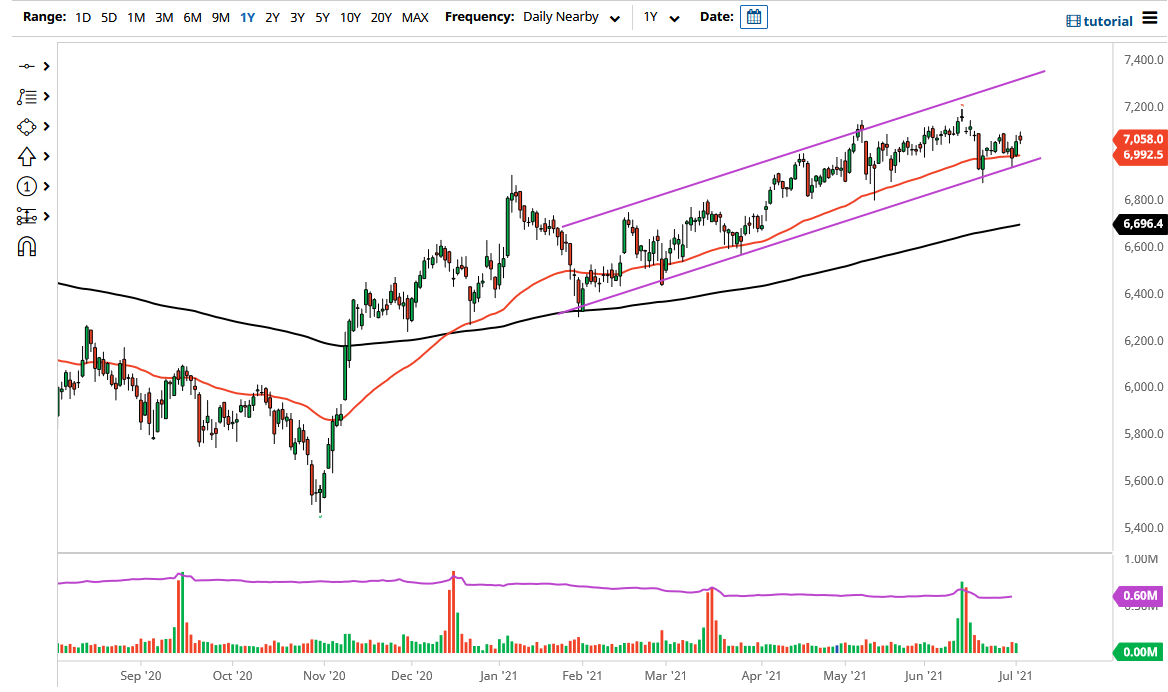

The FTSE 100 initially tried to rally during the trading session on Friday but gave back early gains to show signs of exhaustion. Ultimately, this is a market that continues to show hesitation, but overall, we are still very much in an uptrend and channel. The 50-day EMA sits just below current trading, so I think it is only a matter of time before we see buyers. Ultimately, it is not until we break out of the ascending channel that I would be concerned about the overall trend.

With all that being said, the market breaks above the 7100 level, then it would break above the top of the ascending triangle that we are forming, and of course the ascending triangle is a very bullish look. Because of this, the market is likely to continue towards the 7300 level, which is essentially coinciding with the top of the channel. With that being said, I would be interested in trying to get long of this market on a breakout, or some type of pullback as long as we see a certain amount of support.

If we break down below the bottom of the channel, then it is possible that we could go looking towards the 6800 level underneath, and then perhaps even the 200-day EMA which is starting to reach towards that level. Breaking below that level changes the overall attitude, and I think we are talking about a significant breakdown. With that being the case, I think people would get rather aggressively short of this market, and probably all over the European Union as well.

We also have to worry about the United Kingdom economy, as they still cannot seem to come completely to terms with the idea of being open or not, so the FTSE 100 is a little bit more vulnerable than some of the other indices such as the S&P 500 or the NASDAQ 100. But ultimately, I still favor the upside overall, due to the fact that central banks around the world continue to flood the markets with liquidity and do everything they can to lift the markets in general, including the FTSE 100.