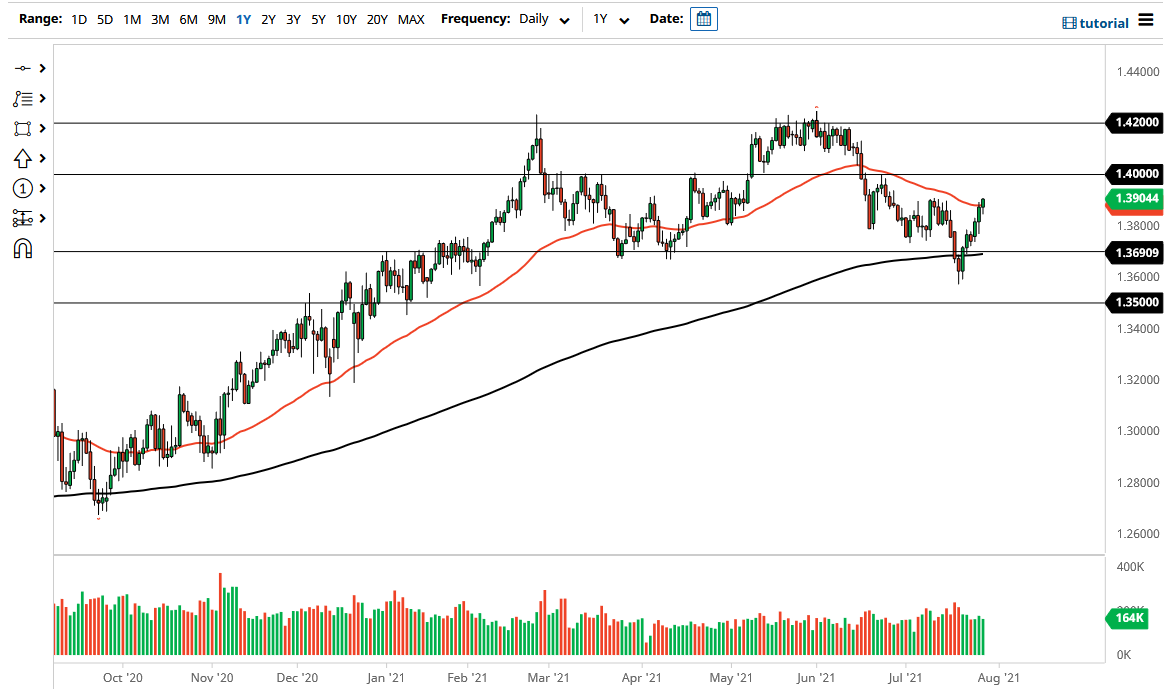

The British pound initially pulled back just a bit during the trading session on Wednesday but then turned around to recapture the 50-day EMA. We are above the 1.39 level, albeit just barely. That being said, the market is likely to go looking towards the 1.40 handle above, as it is a large, round, psychologically significant figure. One thing is for sure though: you can look at today and suggest that perhaps we are breaking out to the upside, and it is very possible we will go looking towards that next level.

This is a market that I think will continue to see noisy behavior and a lot of choppiness that you will have to be aware of. Keep your position size reasonable, but it certainly looks as if the British pound is trying to go to higher levels regardless. If we do pull back, then we may re-enter the previous channel that we had been in. Ultimately, this is a market that I think is trying to figure out where it wants to go for the next several months, but at this point it is very clear to me that the US dollar itself will be driving the pair going forward. With this being the case, I like the idea of buying short-term dips, as long as the US Dollar Index continues to weaken.

Underneath, I see the 1.37 level as a major support level, especially as the 200-day EMA sits right there. Because of this, I think it would be difficult for this market to break through there, but if it does, it is very likely that the market will go looking towards the 1.35 handle. The 1.35 handle will attract a lot of headline attention, so pay close attention to what is going on when it comes to risk appetite. The US dollar is considered to be a “safety asset”, and we also have to pay close attention to the fact that the differential in the Delta variant between the two countries continue to diverge. As the numbers start to switch in the favor of the United Kingdom, we may see a little bit of follow-through in this currency pair. However, if we suddenly move in the direction of the overall “risk off trade”, that could turn things around rather quickly.