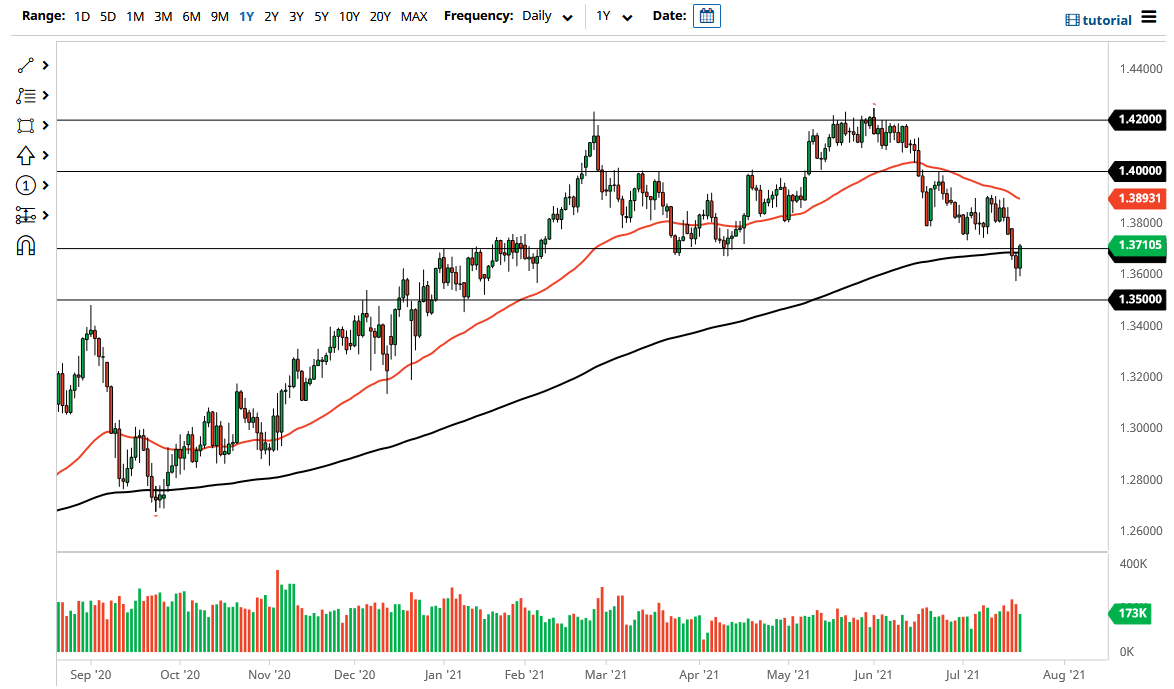

The British pound initially pulled back during the trading session on Wednesday but then turned around to rally towards the 200-day EMA. We eventually broke above there and then cleared the 1.37 level to show signs of resilience. At this point, the market closing at the top of the candlestick does suggest that we are going to see a little bit of follow-through, which is very possible considering that the market had been so oversold. That being said, I would not be surprised at all to see sellers above just waiting to get involved if there is going to be some type of “risk off situation.”

I do believe that the 50-day EMA above, which is sitting at the 1.39 level, is a bit of a “ceiling in the market”, as it is drifting lower and the market does tend to pay very close attention to the 50-day EMA. I am waiting to see some type of exhaustion that I can start shorting, as we have seen a significant breakdown and an overall bullish attitude. Furthermore, the US dollar has had a lot of influence on everything that has happened, as we have been all over the place when it comes to interest rates.

Ultimately, it looks as if we are starting to see a bit of a “risk on” type of move, as we have seen the pound recover a lot of noise, but I still think there is a lot of resistance above that extends all the way to at least the 50-day EMA. As the market is closing at the top of the range, it is very likely that we will at least see an attempt at a bit of follow-through. On the other hand, if we were to turn around and break down below the wick from both Wednesday and Tuesday, that opens up a move down to the 1.35 level, which opens up a move all the way down to the 1.30 handle. This would obviously take a “risk off” type of move, so keep that in mind. We have been all over the place as of late, and at the very least I think we may get a little bit of a relief rally in the short term but we need to be aware of the overhead resistance.