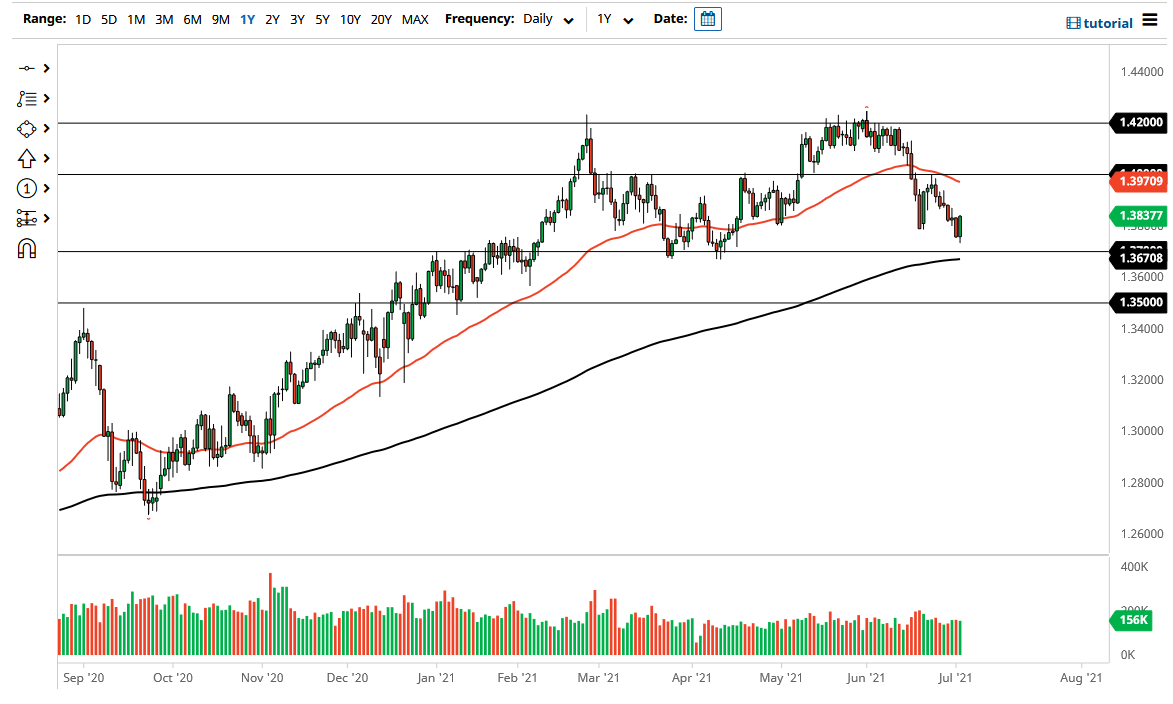

The British pound initially pulled back just a bit during the trading session on Friday, but then turned around to show signs of extreme strength. Because of this, the market looks as if it is ready to form some type of bounce, but we still have quite a bit of noise above that could cause significant trouble. Furthermore, the 1.37 level underneath continues to offer plenty of support, and if we are going to recover here, that would be a very good sign.

The size of the candlestick is rather impressive, as we have taken out the losses on Thursday, but we have a lot of noise just above that could come into play. The question now is whether or not the overall trend will hold. The 200-day EMA underneath should offer support, as it is sitting just below that 1.37 level. If we break down below there, then the market could very well go down to the 1.35 handle, and it was not until the Friday session that it looked like we were going to have any type of stability. After all, we have formed a major “H pattern”, so the question now is whether or not we still have a lot of negativity, or if are we trying to get back into the longer-term bullish pattern.

To the upside, I see the 1.40 handle as a major resistance barrier that is going to be difficult to get above, but if we do, it is very likely that the market will go looking towards 1.42 handle. The 1.42 handle is a major resistance barrier on longer-term charts, so it should not be a huge surprise that we are broken down from there. Having said that, the market has a lot to work to do in the next couple of weeks, and I think that this market will probably bounce between the lines on the chart.

In the short term, it does look like we will get a bit of a bounce, and it will be interesting to see whether or not the 50-day EMA offers resistance, but clearing that could be the first sign of a bigger move. The 1.42 level being violated to the upside would be a huge sign of bullish momentum, perhaps sending the market towards the 1.45 level above.