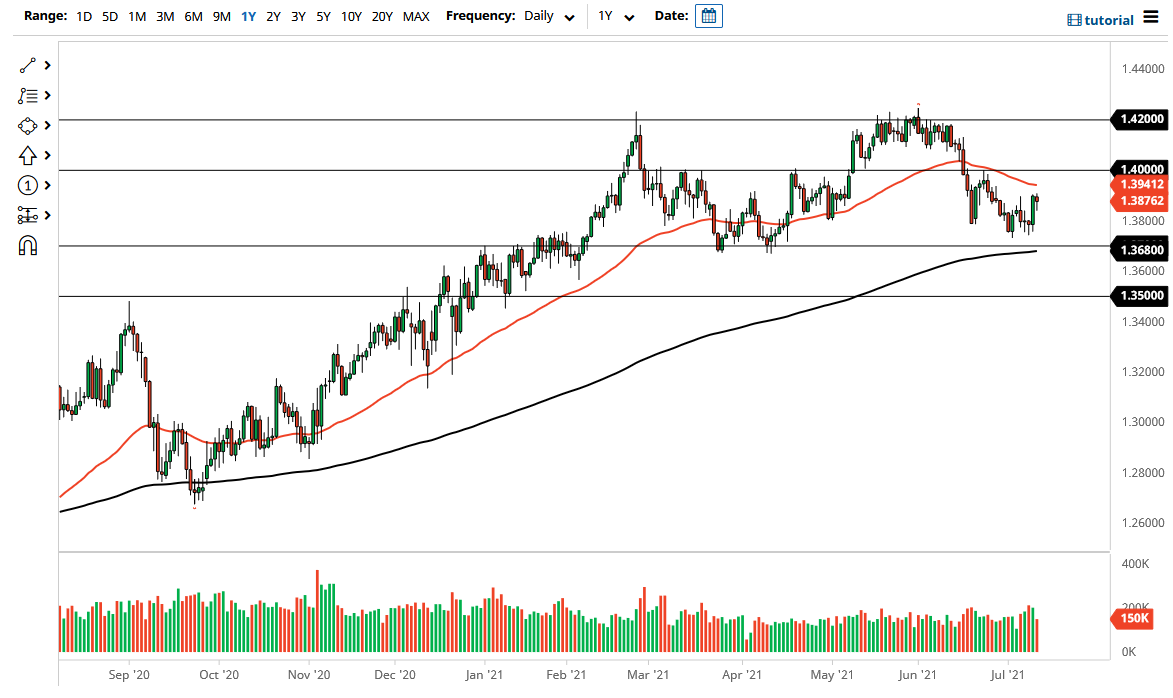

The British pound initially fell during the trading session on Monday to reach down towards the 1.3850 level. However, as Boris Johnson suggested that the United Kingdom was going to open up on July 19, there was a little bit of recovery in the pound during the day. The question now is whether or not this is going to continue the massive move that we had seen on Friday? I do not know that it will, mainly due to the fact that the Friday candlestick would have seen a lot of short covering as well. I suspect at this juncture that the GBP/USD pair continues to be very choppy and therefore should be looked at with a little bit of suspicion.

Looking at the shape of the candlestick, it is a bit of a hammer, which is a good sign. However, there is also the 50-day EMA sitting just above the 1.40 handle which is a large, round, psychologically significant figure that a lot of people will be paying close attention to. If we were to break above there, then it would be very bullish and it is likely that the British pound would go looking towards 1.42 handle. The 1.42 level has been a massive resistance barrier more than once, so I think it is going to continue to be difficult to get above.

That being said, there is just as important an area near the 1.37 level, which has been massive support. Furthermore, it also has the 200-day EMA attached to it, so I think this will keep the British pound essentially sideways in the meantime while we try to sort out what is going to happen next with the global economy. It is because of this that I do not put too much money into this pair, at least not until we can break out above that 500-point range.

If we do break down though, I think that would offer a pretty significant change in attitude and could see a massive selloff. As far as breaking out to the upside, we would need to see some type of massive selloff of the greenback in a huge “risk on move” globally to make that happen. I do not know that we have that in the cards, because there is not that much out there to push the market further into the “reflation trade.”