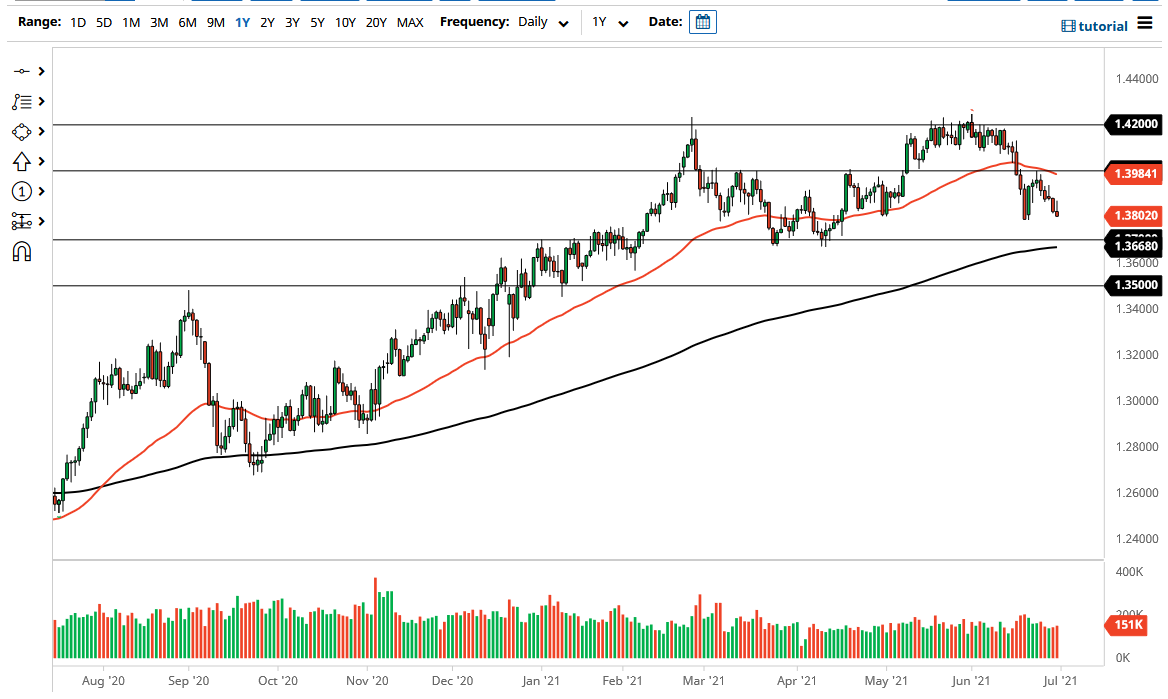

The British pound initially tried to rally during the trading session on Wednesday but gave back the gains rather quickly to fall towards the 1.38 handle. At this point, the market has formed a “H pattern”, which is a relatively negative sign. It looks as if the British pound is probably going to go looking towards the 1.37 handle, which I think is rather important to pay attention to, due to the fact that the market has shown it to be important in the past as we have bounced from there a couple of times.

Furthermore, we have the 200-day EMA reaching towards that level, so I think that the 1.37 level will continue to be a major barrier. Underneath there, we have the possibility of moving down towards the 1.35 handle, which is an area that opens up a “trapdoor to lower prices” if we do break down below it. That would open up a massive amount of US dollar strength, probably not only here but also in other currency markets as well.

Looking at this chart, I do not necessarily have an argument to go higher, but if we were to take out the 50-day EMA and the 1.40 handle to the upside, that could send this market looking towards the 1.42 level. That is an area that has been important more than once, so you need to keep in mind that it probably will take a lot of effort to get above there. If we can get above there, then it is possible that we could have a bigger move for the longer term, but that would take a sudden shift in perception on the US dollar in general.

One thing is for sure: we are seeing a lot of noisy behavior when it comes to the US dollar and inflation expectations. Because of this, the market is likely to see a lot of trouble in this area, but with that being said, I think what we are seeing here is a perfect example of how very few people are confident in which direction the markets are going to go. As long as that is the case, expect choppy behaviors. The jobs number on Friday will capture a lot of attention as well.