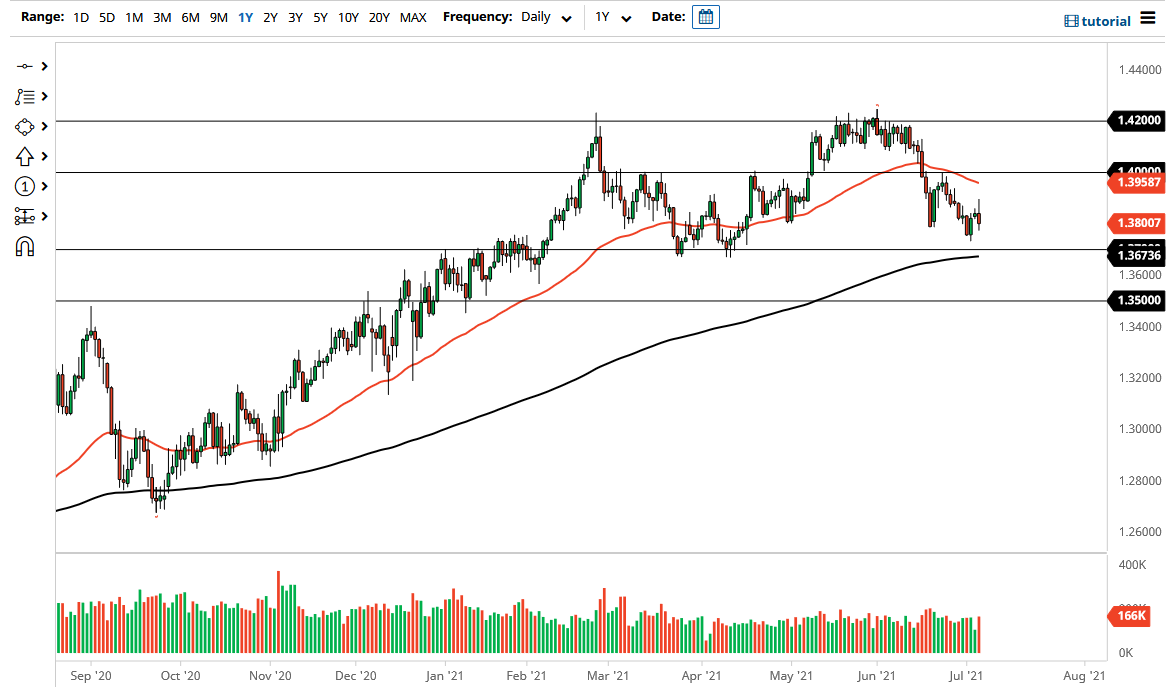

The British pound rallied a bit during the trading session on Tuesday but gave back the gains midday to turn around and start falling again. In fact, we fell enough to pierce the 1.38 handle, and it looks to me as if the market is going to continue to see a lot of selling pressure. Perhaps this was more or less a “risk off” move, due to the fact that the US dollar has strength against multiple currencies, not just the British pound.

It is worth noting that the 1.37 level underneath is important, as it has been massive support in the past, and the 200-day EMA is sitting just below it and offering a bit of support. Looking at this chart, it is very likely that we will continue to find buyers that continue to see that as an area of value. If we break down below the 1.37 level, then it opens up a move down to the 1.35 handle. If we were to break down below the 1.35 handle, then it is likely that the market could break down completely, changing the overall trend and sending the British pound much lower over the longer term.

For what it is worth, when you look at the monthly charts, the 1.42 level above is massive resistance, so I think it makes sense that we pulled back from there. If we break down below the 1.37 handle, then I am willing to look at the most recent attempt to break out above that level as a confirmation of a “double top”, meaning that we could have a bit of a brick wall in that area. I think the next couple months will probably be choppy, as there are a lot of questions out there when it comes to the idea of inflation.

Furthermore, we have a bit of an “H pattern” that we just formed, and the fact that we rolled over during the trading session on Tuesday suggests that perhaps we are in fact going to follow that potential setup. If that is the case, the British pound may be living on somewhat borrowed time. To the upside, if we can get above the 1.40 handle, then I might be a bit more bullish for the longer term.