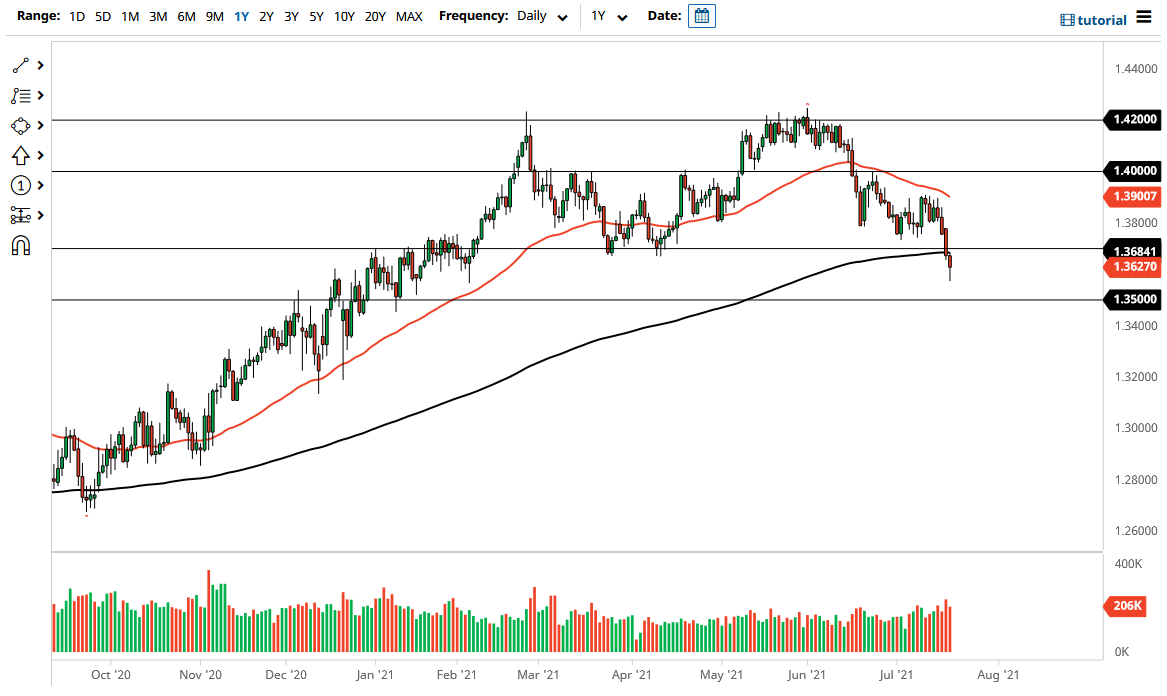

The British pound broke down significantly during the trading session on Tuesday but recovered a bit towards the end of the session. The candlestick was a hammer, but ultimately the market continues to see negative pressure, so I think that as we approach the 200-day EMA, it is very likely that we will start to see selling pressure again. After that, we also have the 1.37 level coming into the picture.

I am looking for signs of exhaustion after we get a little bit of a bounce and then I would be a seller. I think the market will eventually go looking towards the 1.35 handle underneath, which is an area a lot of people would be paying attention to due to the fact there is a significant amount of psychology attached to it and it was also an area where we had seen a bit of support in the past. If we break down below there, the market is likely to have a bit of a “trapdoor effect” where we simply fall rather drastically. As money heads towards the US dollar in a bid for safety, that puts downward pressure on this market.

When you look at this chart, if we were to turn around and break above the 1.37 level, then it is possible that we could go looking towards even higher levels. Ultimately, this is a market that continues to see a lot of noisy behavior, but if we do break above that 1.37 handle, then it is likely we could go looking towards the 1.39 level, where the 50-day EMA currently sits. Breaking above that opens up the possibility of a move to the 1.40 handle, and it would be a complete repudiation of the US dollar and show a huge “risk on” type of move just waiting to happen. With that, I think that we would see the greenback get hammered against almost all currencies, not just the British pound. Beyond that though, there is also a lot of concern when it comes to the increase of COVID numbers in the United Kingdom, despite the fact that the economy has just reopened. I think we will continue to see more negative pressure than anything else.