Bullish View

Buy the GBP/USD and set a take-profit at 1.3900.

Add a stop-loss at 1.3700.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3780 and a take-profit at 1.3600.

Add a stop-loss at 1.3850.

The GBP/USD rose to the highest level in more than a week ahead of the latest US consumer confidence data and Federal Reserve interest rate decision. The pair rose to 1.3820, which is about 1.83% above the lowest level last week.

Fed and US Consumer Confidence

The biggest catalyst for the GBP/USD this week is the Fed decision that is scheduled for Wednesday. The bank is expected to leave interest rates unchanged at the current range of between 0% and 0.25%. Further, the Fed is expected to maintain its quantitative asset purchases intact at the pace of $120 billion per month.

The key point to watch tomorrow will be the language used by the Fed and Jerome Powell. This language will likely provide more clues about the future of asset purchases in the US. In the previous statements, Jerome Powell has insisted that the bank will maintain its policy since the current resurgence of the economy is temporary.

The recent resurgence of COVID-19 cases in the US will probably give the Fed cover to maintain its monetary policy framework. In the past few weeks, the number of COVID cases has jumped in almost all states, pushing health officials to consider a new mask mandate.

The GBP/USD will also react to the latest US consumer confidence data scheduled for later today. The data is expected to show that confidence declined from 127.3 to 123.9 in July. This decline is possibly because of the recent rising of COVID cases even among the vaccinated. Other numbers that will move the pair this week are the durable goods orders scheduled for later today and US GDP numbers set for Thursday.

Further, the GBP/USD is also reacting to the latest developments on Brexit. On Monday, the European Union published some policies that the UK says are inadequate about Northern Ireland.

GBP/USD Technical Analysis

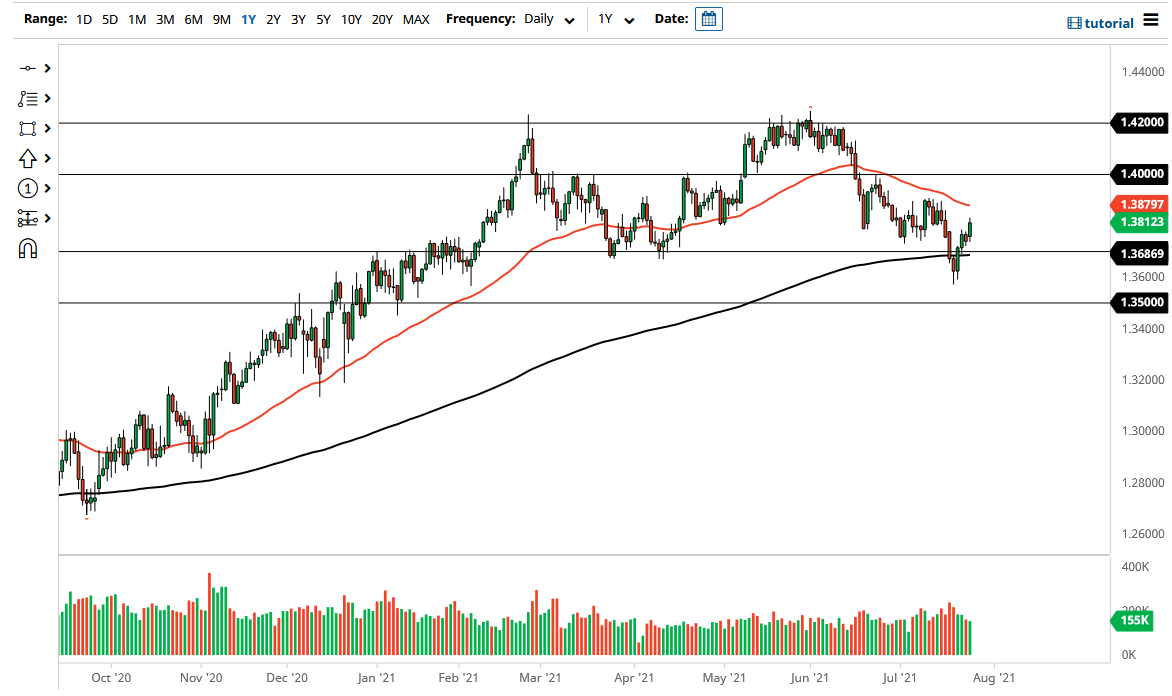

The GBP/USD has bounced back substantially in the past few days. Along the way, it has moved above the 25-day and 50-day moving averages. It has also formed an inverse head and shoulders pattern while the Stochastic oscillator has moved above the overbought level. The pair has also risen above the Ichimoku cloud. Therefore, it will likely keep rising as bulls target the next key resistance level at 1.3900. On the flip side, a drop below 1.3740 will invalidate this price action.