Bullish View

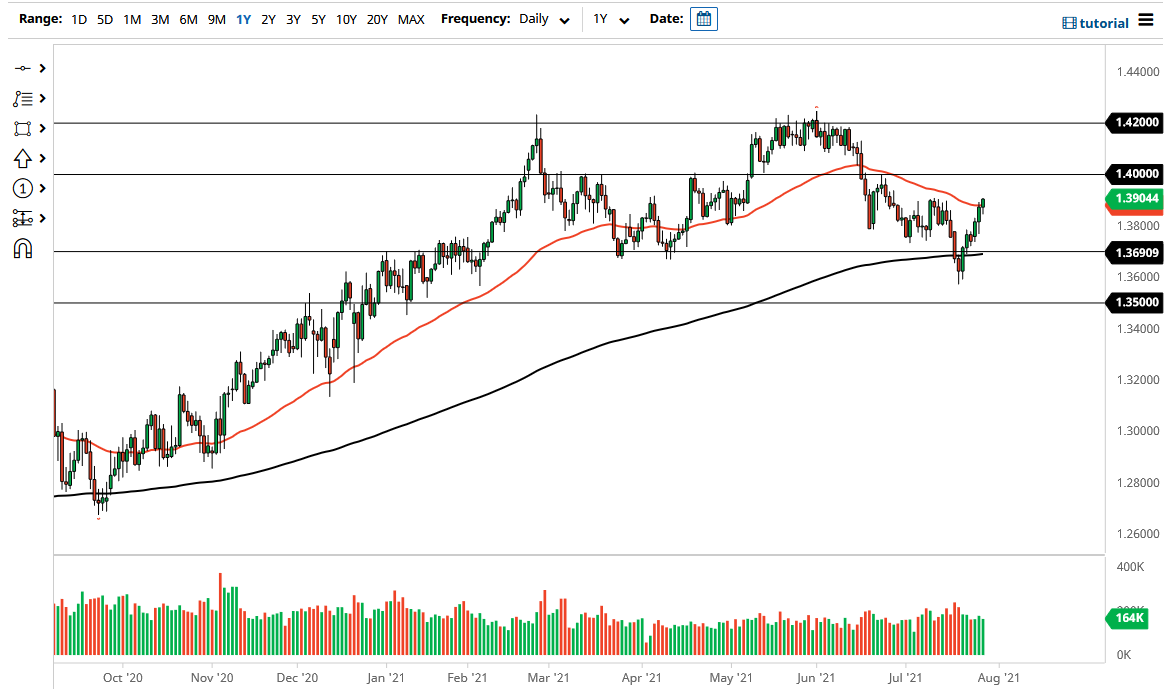

Buy the GBP/USD and add a take-profit at 1.3988 (61.8% retracement).

Add a stop-loss at 1.3826 (38.2% retracement).

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3880 and a take-profit at 1.3726.

Add a stop-loss at 1.3950.

The GBP/USD pair rose above a key resistance level after the relatively weak UK home price growth data and the Fed interest rate decision. It is trading at 1.3907, which is substantially higher than last week’s low at 1.3572.

Fed Decision

The biggest mover for the GBP/USD is the just-concluded Federal Open Market Commission (FOMC) decision that happened on Wednesday. As widely expected, the Fed left interest rates unchanged between 0% and 0.25%. The officials said that they were not interested in hiking interest rates any time soon.

At the same time, they talked about the strong American rebound but warned about the dangers posed by the new wave of the virus. As a result, they said that they would start talking about tapering in the coming meetings. Some analysts expect that the bank will start slowing its asset purchases in the fourth quarter of the year or in the first quarter of 2022.

The GBP/USD also reacted to the relatively disappointing UK home prices data. According to the Nationwide Society, the national home price declined to -0.5% in July after rising by 0.7% in the previous month. This decline was worse than the median estimate of 0.6%. It was also the first time house prices declined silence February this year as the country dealt with rising infections. The prices rose by 10.5% on a year-on-year basis.

Still, an average price still costs about 20,000 pounds more than it did at the same time in 2020. This decline is mostly because of fading demand after the government removed its stamp duty waiver. Later today, the Bank of England will publish the latest mortgage lending and approvals data. Further, the GBP/USD will react to the latest US GDP and initial jobless claims data.

GBP/USD Technical Analysis

The four-hour chart shows that the GBP/USD pair has been in an upward trend recently. And overnight, the pair managed to move above 1.3907. This was an important resistance since it was the previous highest level in July this year. The pair remains above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the overbought level. Therefore, the pair will likely maintain the bullish trend as bulls target the 61.8% retracement level at 1.3988.