Bearish View

Sell the GBP/USD and set a take-profit at 1.3700.

Add a stop-loss at 1.3825.

Timeline: 1-2 days.

Bullish View

Set the buy-stop at 1.3780 and a take-profit at 1.3850.

Add a stop-loss at 1.3700.

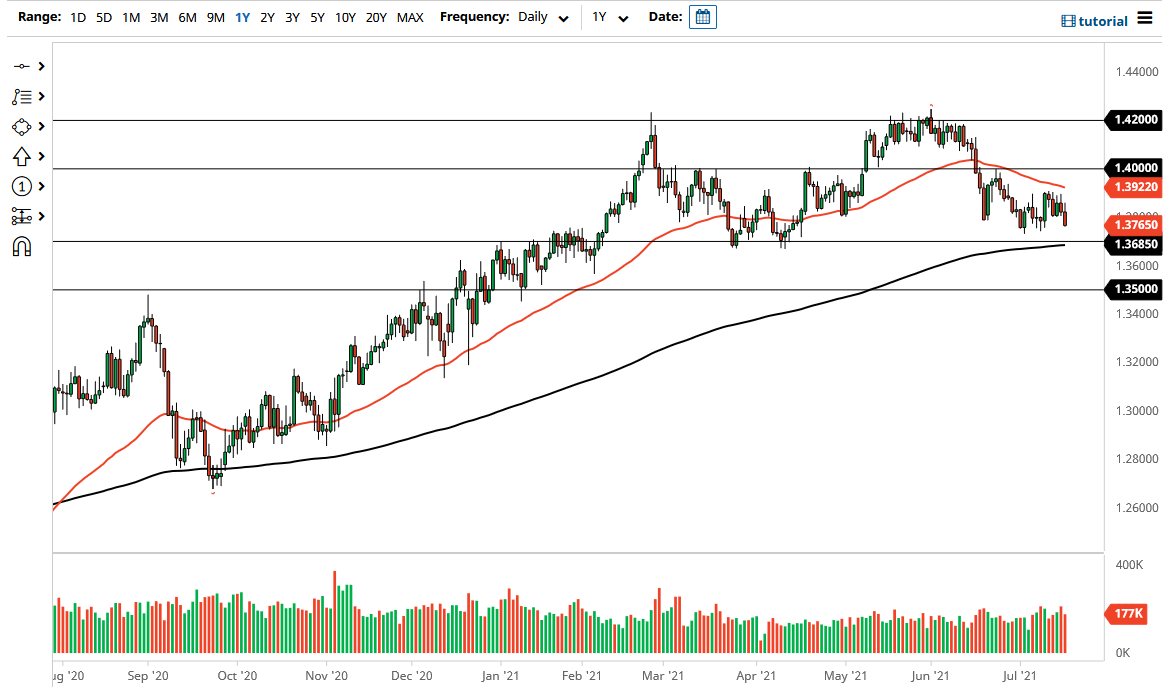

The GBP/USD pair was in the red in early trading as the UK heads for full reopening and as some analysts press the Bank of England (BOE) to end its support program. The pair is trading at 1.3765, which is below last week’s high of 1.3900.

UK Reopening

The biggest catalyst for the GBP/USD this week will be the full reopening that is set to take place today. The government will remove all restrictions and press all adults to continue taking the vaccines. The government will end all measures placed to deal with the pandemic, including mask mandates.

Also, nightclubs and restaurants will have the freedom of operating at full capacity. These measures will only happen in England while other places like Scotland, Wales and Northern Ireland will leave some restrictions in place.

The new phase is expected to boost the UK economy since more businesses will continue to reopen. Still, there are concerns about whether the new phase will see more transmissions of the Delta variant and thus pull the economy lower.

From a data perspective, the UK will have a relatively muted week. The only important numbers will be the UK retail sales that are scheduled to come on Thursday. The data are expected to show that sales rose by 0.5% in June after slumping by 1.4% in the previous month. This decline is then expected to lead to a year-on-year increase of 9.6%. The core retail sales are also expected to rise by 7.8%.

At the same time, the GBP/USD is reacting to hints that the Bank of England will turn hawkish in its upcoming meeting. In a weekend opinion, a Telegraph columnist said that ending QE and raising interest rates will not derail the economy.

GBP/USD Technical Analysis

The GBP/USD was in the red today as the UK moves to reopen. It is trading at 1.3765, which is below the important resistance at 1.3905. On the four-hour chart, the pair is still below the 25-day and 15-day moving average and is along the lower line of the Bollinger Bands. Oscillators like the MACD and the Relative Strength Index (RSI) also declined. Therefore, the pair will likely keep falling as bears target the next key support at 1.3700. The alternative scenario is where the pair bounces back and moves to the resistance at 1.3900.