Bearish View

- Set a sell-stop at 1.3785 and a take-profit at 1.3700.

- Add a stop-loss at 1.3850.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.3840 and a take-profit at 1.3900.

- Add a stop-loss at 1.3785.

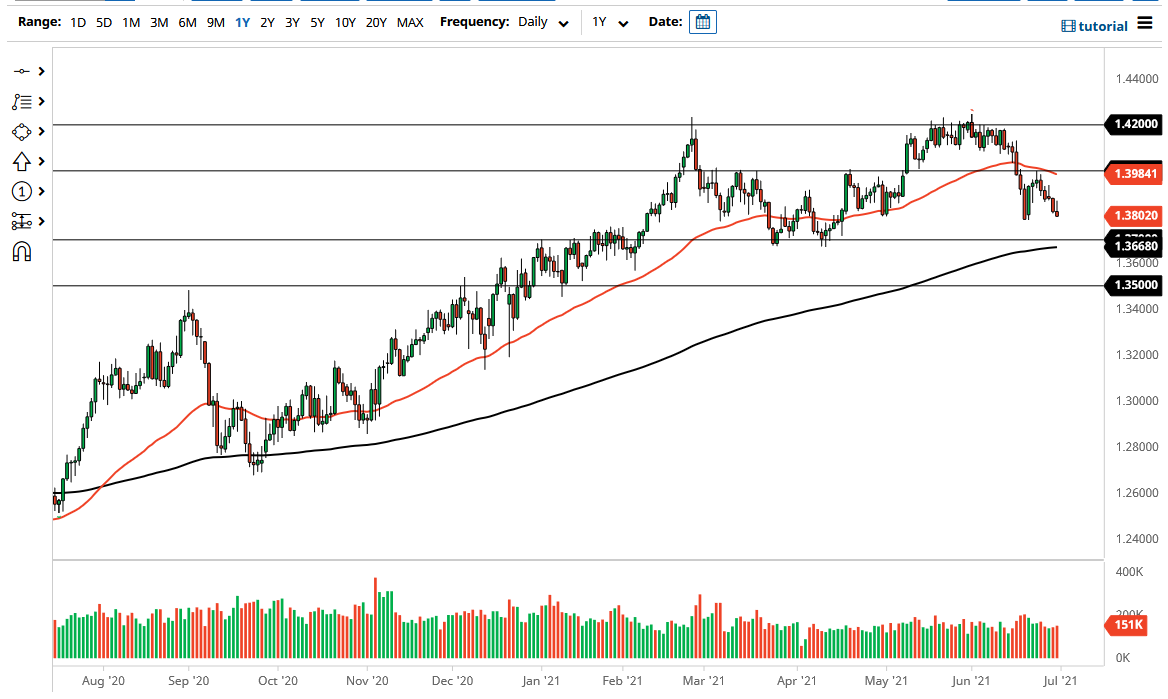

The GBP/USD declined for the past six consecutive days as investors remain concerned about the spreading delta variant of coronavirus. It is trading at 1.3815, which is about 1.3% below the highest point last week.

Key Economic Numbers Ahead

The British pound has eased against key currencies as investors remain concerned about the health of the UK economy. This is after the Boris Johnson administration decided to extend the lockdown to later this month after recording higher coronavirus cases.

The GBP/USD will have three key catalysts today. Markit will publish the latest UK Manufacturing PMI data. Based on the previous preliminary data, analysts expect the data to show that the country’s Manufacturing PMI rose to 64.2 in June. This figure will be substantially above the expansionary zone of 50. It will signify that the country’s manufacturing sector remains steady.

The pair will also react to the latest US manufacturing data by Markit and the Institute of Supply Management (ISM). Like in the UK, analysts believe that the country’s manufacturing sector did well, with the ISM figure expected to come in at 61.0.

Other important US economic data scheduled for today are the initial and continuing jobless claims numbers. On Wednesday, data by ADP revealed that the US added more than 692,000 payrolls in June after adding 886k in the previous month. The Bureau of Labor Statistics (BLS) will publish the latest non-farm payrolls numbers set for tomorrow.

The GBP/USD will also be affected by a statement by Andrew Bailey, the Bank of England (BOE) governor. This will be the first speech after the bank delivered its interest rate decision in June. The governor’s speech will likely set the tone for what to expect later this month.

GBP/USD Technical Analysis

The GBPUSD has been under pressure lately as concerns about the UK recovery remain. It has moved below the 25-period and 50-period exponential moving average on the four-hour chart. It has also moved below the Ichimoku cloud while the Relative Strength Index (RSI) has been on a downward trend. Therefore, the path of least resistance for the pair is lower. This will be validated if it moves below the important support level at 1.3785, which was the lowest level in June. If this happens, the next key level to watch will be 1.3700.