Forex investors tried to take advantage of the recent strong decline in the price of the GBP/USD currency pair to return to buying and settle around the 1.3745 level. This is after strong selling that pushed it towards the 1.3571 support level, the lowest in five months. The return of investors to risk again contributed to the increase in sterling gains. The recovery in stock markets has indicated that investors may have put aside recent concerns related to the rapid spread of the Covid-19 Delta variant that threatens to slow the global economic recovery. We recently noticed that when investors are afraid, the pound tends to depreciate against the euro, dollar, franc and yen but gains against emerging market currencies as well as commodity currencies such as the krona, Australian, Canadian and New Zealand dollars.

Commenting on this, Shihab Galinus, FX strategist at Credit Suisse says: “The seemingly sudden explosion of Covid-19 Delta's shifting risks to placing 'higher interest' global markets is the main story of the week." "It is still possible that higher rates of Covid-19 infection will not translate into hospitalization rates that dictate a reversal of economic reopening," he adds.

We expect RORO to dominate the markets over the coming days and risk assets such as stocks and commodities to rise if investors dismiss their concerns about a global jump in delta states.

"Investors' appetite for risk continues to recover from Monday's dip, but the more positive sentiment has slowly moved into the FX markets," said Ned Rambletein, FX analyst at TD Securities. This week, markets were panicked by the rise in global Covid-19 cases, driven by a delta type of disease that appears to be more transmissible than its predecessors. This means that even countries - such as the UK - with high levels of vaccination penetration are unable to escape a new wave of infection.

Developments surrounding this new phase of the pandemic are likely to dampen the economic recovery in the Eurozone, the United Kingdom and the United States over the coming days and weeks. Investors believe that developed markets can withstand a new wave of infections in the hope that vaccines will cut the link between cases and hospitalization, but for those countries where vaccination prevalence is low, more stringent mitigation measures are needed.

Southeast Asia and Australia are of particular concern: this region weathered the Covid storm in 2020, but the delta variant proved difficult to escape. We expect markets to remain volatile as investors grapple with contagion data from around the world.

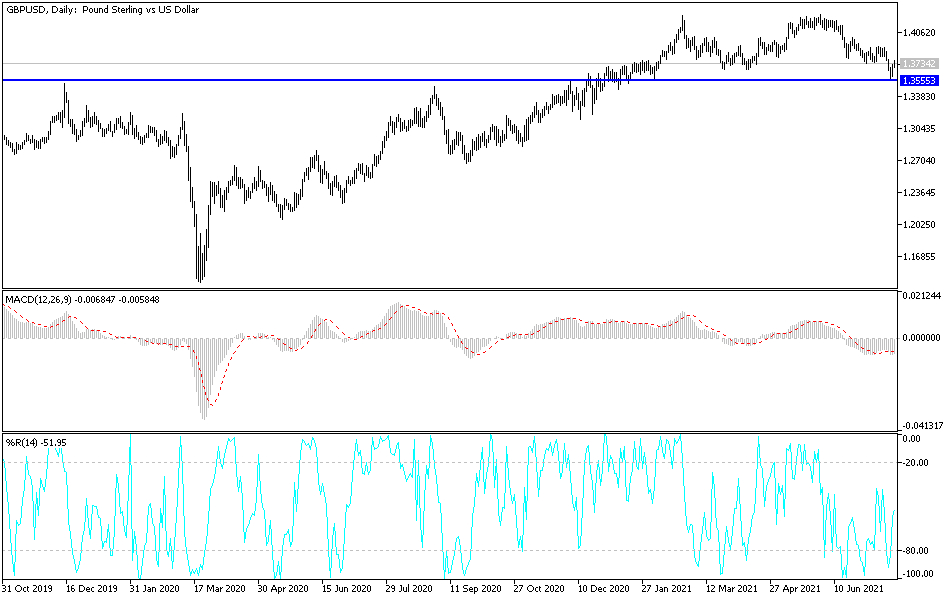

According to the technical analysis of the pair: With the price of the GBP/USD currency pair approaching the 1.3800 resistance level, it will enter a relatively neutral phase instead of a strong bearish look, according to the performance on the daily time frame. This level may motivate the bulls to move towards the psychological resistance level 1.4000 again, which is the most important for an actual shift in the trend. On the downside, a move towards the 1.3600 support level will stimulate the bears to move towards stronger support areas.

As for the economic calendar data today: Today will be statements by some monetary policy officials of the Bank of England. From the United States, the number of weekly jobless claims and existing home sales will be announced.